4 trends shaping consumer research in 2025

Consumer research is changing fast. AI speeds decisions, privacy-first data protects trust, and real-time feedback reveals changing behavior. Brands that combine these signals gain a sharper, faster, and more accurate view of what consumers want next.

Consumer research is changing faster than most brands realize. In 2025, U.S. consumers are moving at lightning speed, switching preferences, expecting personalization, and holding brands accountable for privacy.

Quarterly surveys and static reports no longer provide the insight required to make timely decisions. Instead, research teams are adopting methods that are faster, more predictive, and grounded in real-world behavior.

The following four trends are defining the new era of consumer research.

1. AI-driven customer insights

Imagine being able to see what your customers want before they even say it. Generative AI and predictive analytics are making this possible, giving research teams the ability to model behavior in real time.

Early adopters are already reaping the rewards. AI can highlight segments showing early signs of churn, simulates adoption of new products, and identifies changes in sentiment before they become visible in traditional data.

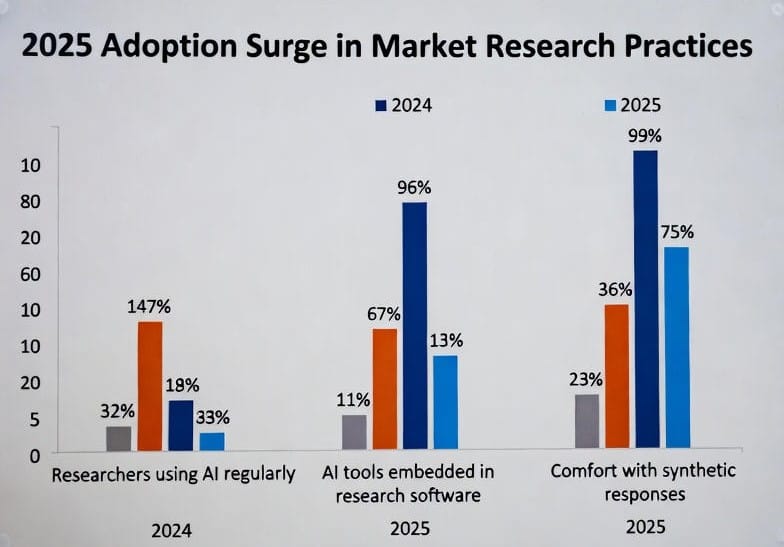

According to the 2024 GRIT report 61% of insights professionals now use AI or predictive analytics in their work, and those who do report significantly shorter time-to-insight and higher confidence in decision making (Greenbook GRIT 2024). McKinsey estimates that companies applying advanced analytics to customer insights achieve 15–20% faster revenue growth.

2. Privacy-first research models

Consumers want brands to understand them, but not at the expense of privacy. With privacy rules such as CCPA and GDPR and the decline of third-party cookies, brands have to rethink how they collect and use data. First-party data, consent-driven panels, and anonymized datasets are becoming standard practice.

Synthetic data is central to this change. By generating datasets that mimic real consumer behavior without exposing personal information, research teams can safely simulate adoption, forecast demand, and test campaigns.

The reliability of synthetic data depends on the quality of the source. Platforms such as Rwazi using privacy-first models can run experiments, test pricing, and explore niche segments safely. When synthetic data is grounded in verified consumer behavior, research teams can scale insights without putting trust at risk.

3. Always-on consumer feedback

The pace of the U.S. market requires continuous feedback loops. Static, periodic surveys cannot track rapid change in behavior or sentiment. Always-on consumer feedback, through mobile-first tracking, live sentiment tools, and AI-assisted interviews, provides real-time visibility into emerging trends.

Brands using continuous feedback can detect product usage changes, satisfaction dips, interest spikes, and competitive influence as they happen.

A 2024 BCG study found that companies using real-time consumer intelligence platforms are 1.7× more likely to report above-average revenue growth.

Rwazi’s delivers this continuity through a global network of verified consumers who complete short, incentivized mobile tasks daily. The output is a persistent, geolocated stream of what people actually buy, use, and abandon, updated in real time.

4. Integrated behavioral + attitudinal insights

What people say and what people do have historically lived in separate silos. Closing that gap is now table stakes.

Behavioral signals (purchase frequency, app usage, store visitation, category switching) reveal what is happening.

Attitudinal signals (motivations, barriers, perceived value) explain why it is happening.

When layered together, the combination predicts outcomes with far greater accuracy than either dataset alone. Forrester predicts that by 2027, 65% of enterprise market research budgets will flow to platforms that natively fuse behavioral and attitudinal data (Forrester, 2024).

U.S. brands combining behavioral and attitudinal layers can design products and communications that resonate more deeply, rather than relying solely on stated preferences.

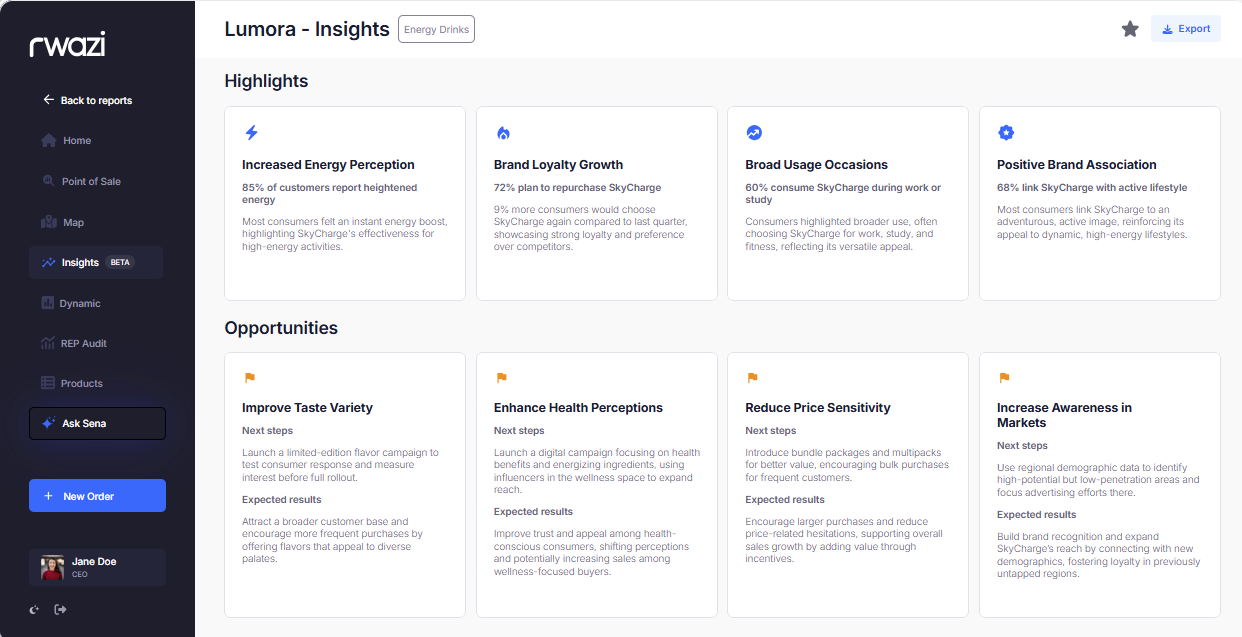

With Insights, every behavioral data point is paired with contextual attitudinal questions asked at the moment of truth. The result is a single source of truth that eliminates the behavior gap.

Conclusion & forward insight for 2026

In 2025, consumer research moved from reactive measurement to predictive, integrated insight. Looking to 2026, the bar rises, Predictive AI, privacy-first practices, always-on feedback, and integrated behavioral and attitudinal data are now essential capabilities for brands.

Brands that adapt to these four trends will not only modernize their research function but will also establish a competitive advantage in understanding and anticipating consumer needs.

Rwazi, provides verified consumer data across multiple markets, plays a key role in this transformation through its AI tools, Lumora and Sena.