A new era for delivery competition as China’s Meituan bets $1 Billion on Brazil

China’s Meituan is shaking up Brazil’s delivery market, taking on iFood with lower fees and bigger discounts. The battle could reshape how platforms compete across Latin America

A major disruption in Latin America’s delivery market

In 2025, China’s Meituan announced a $1 billion investment to enter Brazil’s food delivery market, signaling a bold challenge to the region’s dominant player, iFood. With Brazil’s food delivery industry valued at $23.7 billion in 2025 and projected to grow to $36.7 billion by 2030 (18% CAGR), Meituan’s entry is poised to reshape competition, pricing, and consumer expectations in Latin America’s largest economy.

Meituan: the challenger from China

Meituan, founded in 2010, is the world’s largest food delivery platform, processing over 60 million daily orders and generating $46.6 billion in revenue in 2024, outpacing DoorDash ($9 billion) and Uber Eats ($11 billion). Meituan, serving 450 million active users with a cost-efficient delivery model, however China’s slowing economy and regulatory scrutiny have capped domestic growth, this has driven Meituan to expand abroad, with Brazil as its latest target.. This move is part of a broader shift by Chinese tech giants like Shein, Temu, TikTok Shop, and Didi, who are turning to Latin America, the Middle East, and Southeast Asia as U.S. and European markets tighten with tariffs.

Meituan is deploying a proven strategy by lowering commissions (10-20% vs. iFood’s 27%), using higher rider pay, and giving consumer discounts. In Hong Kong, this approach doubled restaurant sales within two years by attracting merchants frustrated with high fees.

Rwazi’s 2025 Brazil survey shows 42% of restaurants are frustrated with iFood’s 27% commission fees—the percentage they pay iFood per order, which cuts into their profits. For example, on a $20 order, a restaurant pays $5.40, leaving less for their bottom line. This frustration makes 45% of restaurants open to switching to platforms like Meituan, which offers lower rates of 10-20%

Why Brazil? the crown jewel of Latin America

Brazil’s 214 million population, 85% smartphone penetration, and $157 billion trade relationship with China in 2024 make it a prime target for Meituan. The country’s food delivery market is growing rapidly, Yet iFood’s dominant 80% market share, paired with its steep 27% commission rates, is fueling growing frustration among businesses and consumers alike.

Rwazi’s 2025 survey suggests 58% of São Paulo consumers are eager for lower delivery costs, frustrated by high prices driven by platform fees. Similarly, 70% of small restaurants report feeling pressured by iFood’s 27% commission rates, which cut into their profits on every order. These insights highlight a market ripe for Meituan’s lower-fee approach.

Meituan’s investment, announced alongside Brazilian President Lula in Beijing, leverages strong China-Brazil ties. Its drone delivery technology, which cut logistics costs by 40% in China, could give it an edge in urban hubs like São Paulo and Rio de Janeiro. Yet, challenges such as Brazil’s labor regulations and iFood’s 300,000 restaurant partnerships create steep barriers. Rwazi’s data shows 65% of Brazilian delivery workers prioritize higher pay, aligning with Meituan’s rider-friendly approach, but scaling to rural areas will be tough.

Sentiment pulse: Social media reveal mixed feelings about Chinese investments like Meituan’s. Some Brazilians welcome the projected 15,000 jobs, while others fear competition could harm local industries. With $27 billion in Chinese investments flowing into Brazil, Meituan benefits from favorable ties, but navigating public sentiment is critical. Rwazi’s real-time data can help businesses monitor these shifts and adapt.

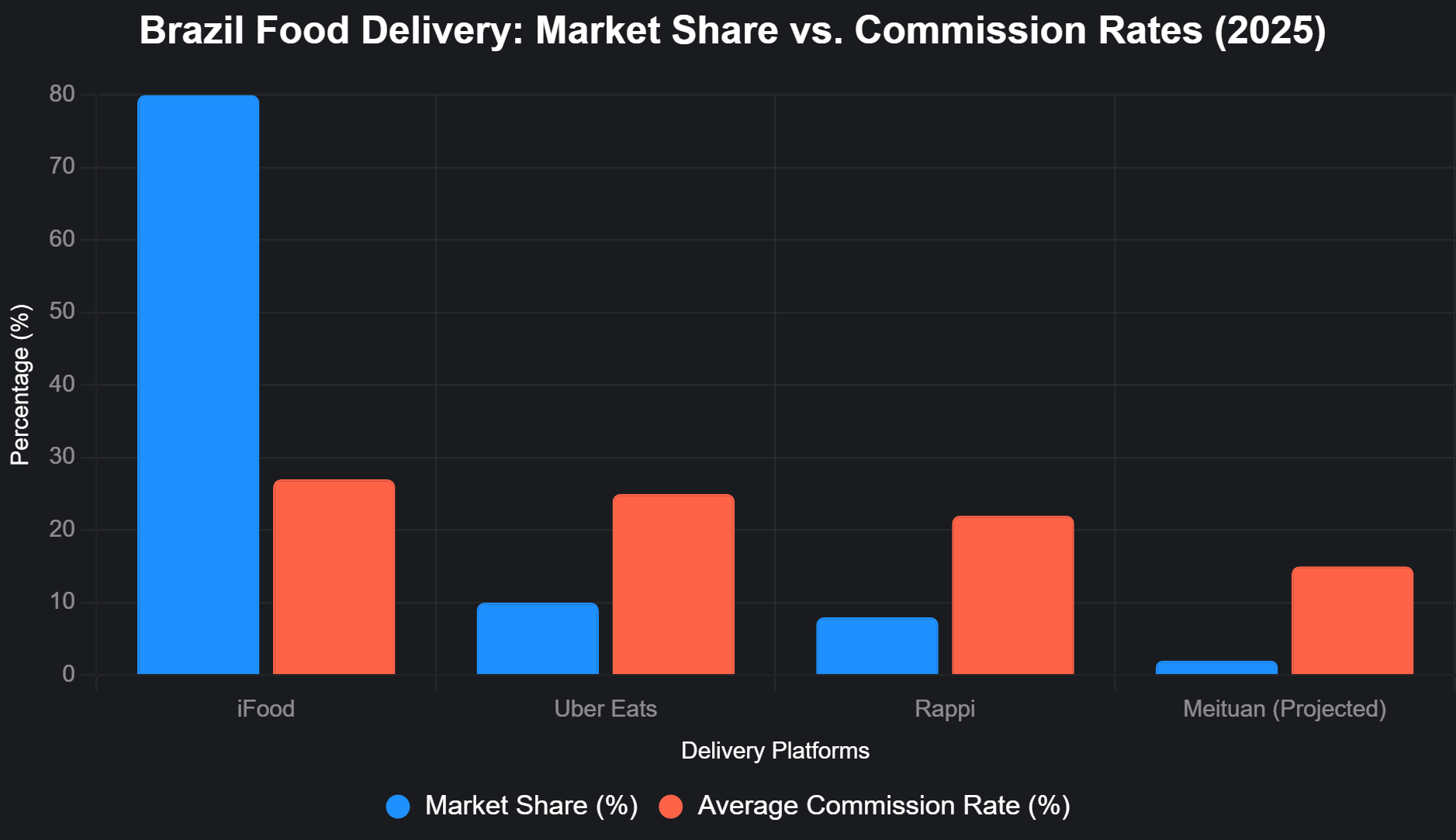

Competitive landscape: a visual snapshot

Meituan’s low-commission strategy could disrupt iFood’s dominance. The chart below compares market share and commission rates of key players in Brazil’s food delivery market, highlighting Meituan’s potential to gain traction by undercutting competitors.

Our analysts project Meituan could capture 15% market share by 2026 by leveraging lower fees, potentially eroding iFood’s dominance if merchants and consumers switch. However, iFood’s 65 million monthly orders and strong brand loyalty pose significant hurdles.

Can iFood hold its ground?

iFood’s dominance is formidable, with 300,000 restaurant partners and 65 million monthly orders. Yet, its high commissions have created vulnerabilities. Meituan’s track record in Hong Kong and Saudi Arabia, where it forced Deliveroo out through aggressive pricing suggests it’s willing to sacrifice short-term profits for market share.

Rwazi’s data indicates that 30% of Brazilian consumers would switch platforms for a 20% reduction in delivery fees, a threshold Meituan is likely to meet.Still, iFood could counter with loyalty programs or faster delivery times, leveraging its established network.

Lessons for business leaders

Meituan’s entry validates a universal truth that business models reliant on high margins are vulnerable to cost-efficient challengers. iFood’s 27% commissions, once a strength, now invite disruption. CEOs must prioritize competitive pricing and customer satisfaction to fend off challengers.

For example, Rwazi’s data shows that 40% of Brazilian restaurants would adopt a new platform offering real-time analytics to optimize operations—a gap iFood has yet to fill. Beyond Brazil, incumbents in any industry should anticipate disruptors from emerging markets, using tools like Rwazi to stay agile.