Geopolitics, AI and U.S. business strategy: what founders must know in 2025

Global AI spending will hit $1.5T in 2025, but U.S. firms face geopolitical, regulatory, and supply-chain challenges that could impact efficiency and growth.

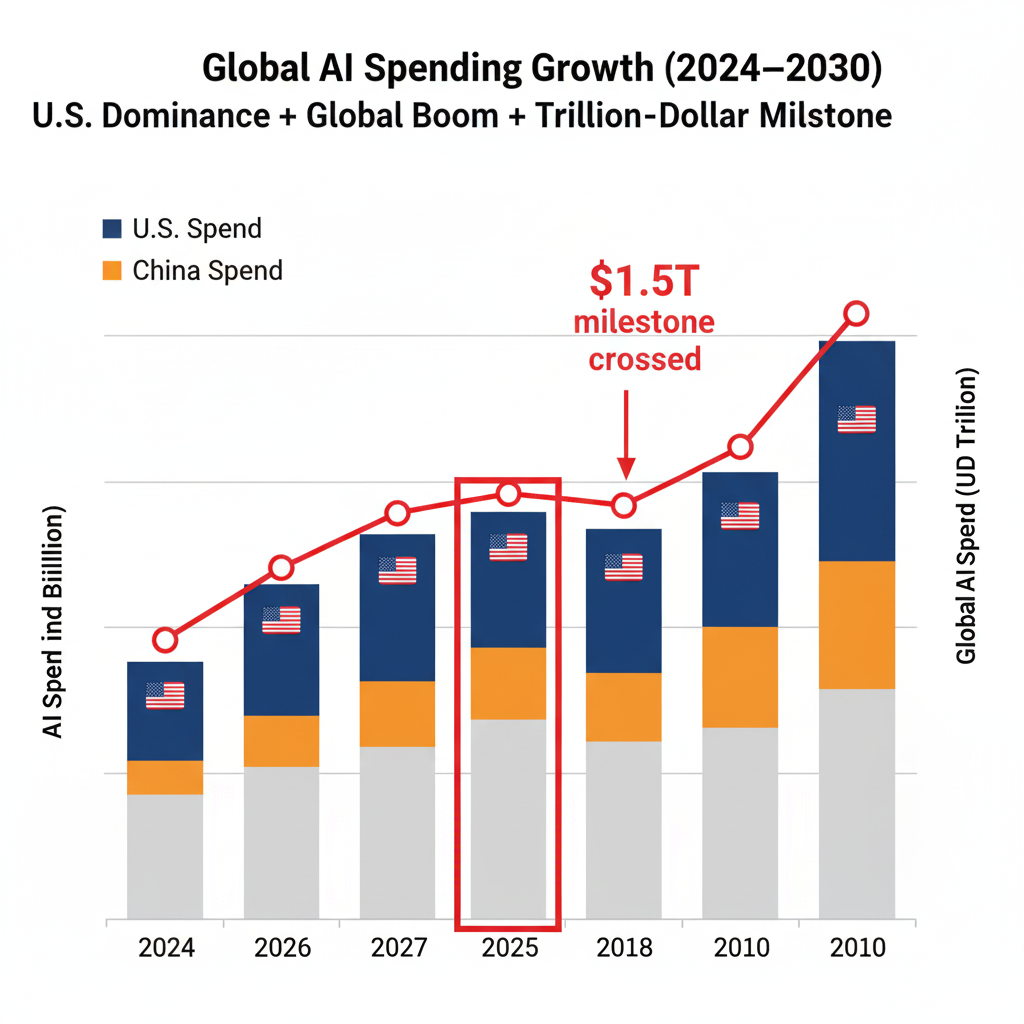

AI spending reaches new heights

Global AI spending is expected to reach $1.5 trillion in 2025, according to Gartner. The U.S. and China are driving most of this growth, as companies across finance, logistics, healthcare, and manufacturing race to adopt AI. But this boom isn’t just about money.

Advanced AI relies on high-end chips, cloud infrastructure, and skilled talent and access to all three is increasingly shaped by politics as much as technology. KPMG notes that fragmented regulations, export controls, and geopolitical tensions are now key factors shaping AI strategy.

U.S. market dominance brings dependencies

The U.S. AI market is estimated at $173.56 billion in 2025, projeted to reach $851 billion by 2034, a 19.4% CAGR, according to Precedence Research and IDC. Forty percent of this value comes from software and services, with the rest split across hardware, cloud, and enterprise solutions.

Despite its size, the market faces dependency risks. Around 65% of U.S. AI firms rely on foreign cloud infrastructure, primarily AWS and Azure data centers abroad (KPMG). Semiconductor reliance is equally critical: 80% of advanced chips are manufactured in Taiwan, exposing firms to geopolitical flashpoints. Rwazi mapping shows U.S. logistics firms rerouting AI supply chains in Africa due to Red Sea disruptions, increasing costs by 12%.

Rising risks in AI deployment

Nearly a third of generative AI projects are expected to be abandoned after proof of concept, according to Gartner. Causes include weak governance, unclear business value, and increasingly strict data localization requirements. U.S.-China competition amplifies these risks: CHIPS Act subsidies accelerate domestic fabrication, but export bans on NVIDIA GPUs to China delayed 25% of AI projects (Gartner, 2024).

Regulatory timelines add complexity. EU AI Act 2024, U.S. Executive Orders on AI 2023, and China’s 2025 data rules all force companies to rethink architecture, data storage, and deployment strategies. At the same time, alliances like AUKUS are helping secure talent pipelines and strategic resources from allied markets.

Turning risk into opportunity

Business leaders can turn these challenges into real opportunities by leaning on data and planning strategically. Begin by mapping your dependencies and spotting weak points in your supply chains.. Rwazi’s geo-tagged mapper data highlights emerging market risks before they become a problem.

It also helps to build AI systems in separate, flexible parts. That way, data can be stored regionally to follow local rules without slowing down performance.

Every proof-of-concept should link directly to clear business goals so you can track results and keep project failures under 10%. Staying ahead of policy changes is just as important, the Rwazi dashboard can monitor responses to regulations and shifts in over 100 markets in real time, helping companies act before their competitors do.

What founders should do next

AI success in 2025 isn’t just about spending; it’s about strategy. The U.S. market is massive, but regulatory, supply-chain, and geopolitical forces are shaping who wins. Business leaders who integrate governance, measure outcomes, and leverage local insights will define the next phase of AI adoption.

Rwazi's delivers hyper-local data to quantify these risks, and help you turn geopolitics into your competitive edge.