Global backlash: why US brands are losing trust abroad

Global consumers are turning away from US brands, not because of quality, but because of identity. To navigate rising nationalism and geopolitical backlash, brands must localize, listen, and lead with empathy to stay relevant in a shifting global market.

In today’s fractured global landscape, branding is no longer just about logos, slogans, or product features, its increasingly about national identity. There was a time when American brands didn’t just dominate markets, they defined them. From Coca-Cola to FedEx, the red, white, and blue label represented excellence, innovation, and global aspiration. McDonald’s golden arches were seen as a universal stamp of consistency and quality. Even in far-flung regions, owning a product by a US company often came with a sense of prestige.

But something has changed.

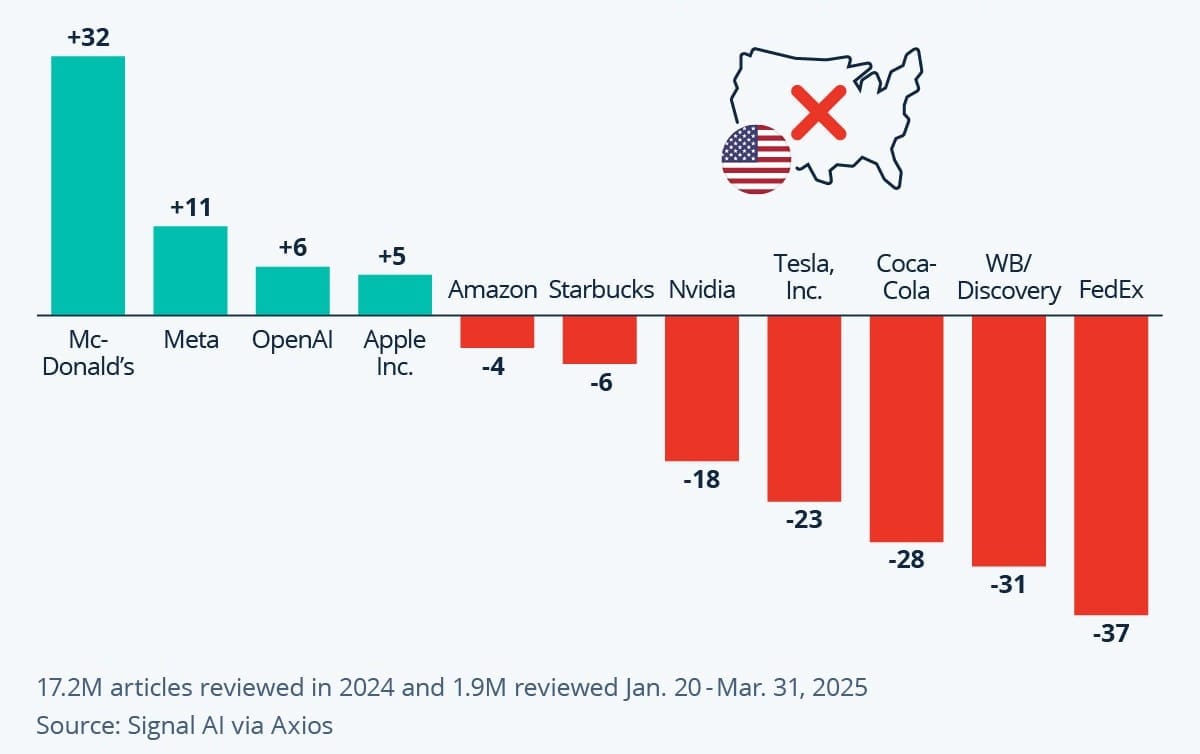

Since January, nearly 70% of major US companies analyzed have experienced a decline in favorability among global consumers. The drop isn’t isolated or trivial, it cuts across sectors and geographies. FedEx has seen sentiment plunge by 37%, Warner Bros. Discovery by 31%, and even Coca-Cola—once a symbol of global unity—is down by 28%.

When national identity drives consumer choice

Movements like “Buy Canadian” are gaining traction, illustrating a shift in how consumers view not just products, but the countries behind them. In Canada alone, US brand sentiment has plummeted by 45%. Mexico, long considered a steady trade partner, now shows a 38% decline in perception. Across Europe, where American tech and culture once enjoyed fanfare, sentiment is down by an average of 25%. The backlash isn't necessarily tied to the companies themselves, but rather the larger political climate surrounding the US. Global consumers are no longer separating politics from purchasing. Where a product comes from; its “brand nationality” has become as relevant as the product’s quality, price, or innovation. In a world defined by heightened geopolitical tensions, American identity has turned from an asset into, in some cases, a liability.

Interestingly, this sentiment drop isn’t as stark everywhere. In Asian markets, the decline in brand favorability sits at around 12% on average. While still notable, the softer landing suggests that distance from direct political friction may insulate some regions, at least for now.

Who’s still winning—and why?

Not all US brands are struggling. McDonald’s and Meta stand out as exceptions, with increases of 32% and 11% respectively. These outliers suggest that when companies embed themselves deeply into local culture either through service adaptation or robust community engagement they can maintain or even grow consumer trust. McDonald’s success, for instance, may lie in its decades of local menu experimentation and global operations run by regional leadership. Meta, on the other hand, benefits from a globally integrated digital platform that transcends national boundaries, often functioning more as infrastructure than as a national brand.

Lessons for business leaders: Evolve or Fade

For business leaders, the lesson is clear: surviving and thriving in this climate will require more than global ad buys or celebrity endorsements. Companies that are managing to defy the trend, such as McDonald’s (+32%) and Meta (+11%), haven’t done so by accident. Their advantage likely stems from deeper local integration, platform-level relevance, and the ability to position themselves as global citizens rather than national symbols.

Scaling a single brand across borders with minimal adaptation, is no longer enough. To earn trust in global markets, brands must go further: hiring local leadership, embedding into community causes, and adapting offerings to reflect regional values. This is especially vital in markets where consumer choice is increasingly viewed as a political act.

Moreover, companies can no longer afford to be reactive. In this era of hyper-connectivity, real-time sentiment tracking and geopolitical risk analysis must be integral to strategy, not just PR. CEOs need to treat brand perception as a moving target, one shaped as much by headlines and hashtags as by quality and price. The decline in global sentiment toward US brands isn't merely a PR challenge, it’s a wake-up call. It signals a world where brand allegiance is earned, not inherited, and where trust is becoming as local as the consumers who give it.