Google retains 90% search dominance despite the AI hype

Despite AI growth, Google still controls 90% of global search. Explore what this means for brands, publishers, and discovery strategies.

Why Google still dominates search despite the AI revolution

Artificial intelligence has reshaped how people interact with information. Conversational tools summarize insights, answer complex questions, and guide decisions in seconds. The change feels dramatic. Discovery is becoming conversational, contextual, and faster.

Despite rapid adoption of AI assistants, Google search market share still hovers around 90% globally, maintaining its position as the primary gateway to the web. The contrast between AI excitement and persistent search dominance reveals discovery is evolving, not being replaced.

AI is changing how people explore ideas, but search remains central to validation, navigation, and transactions. Understanding this hybrid discovery environment is now essential for marketing, product, and growth teams.

The numbers don't Lie: search engine 2025 market share breakdown

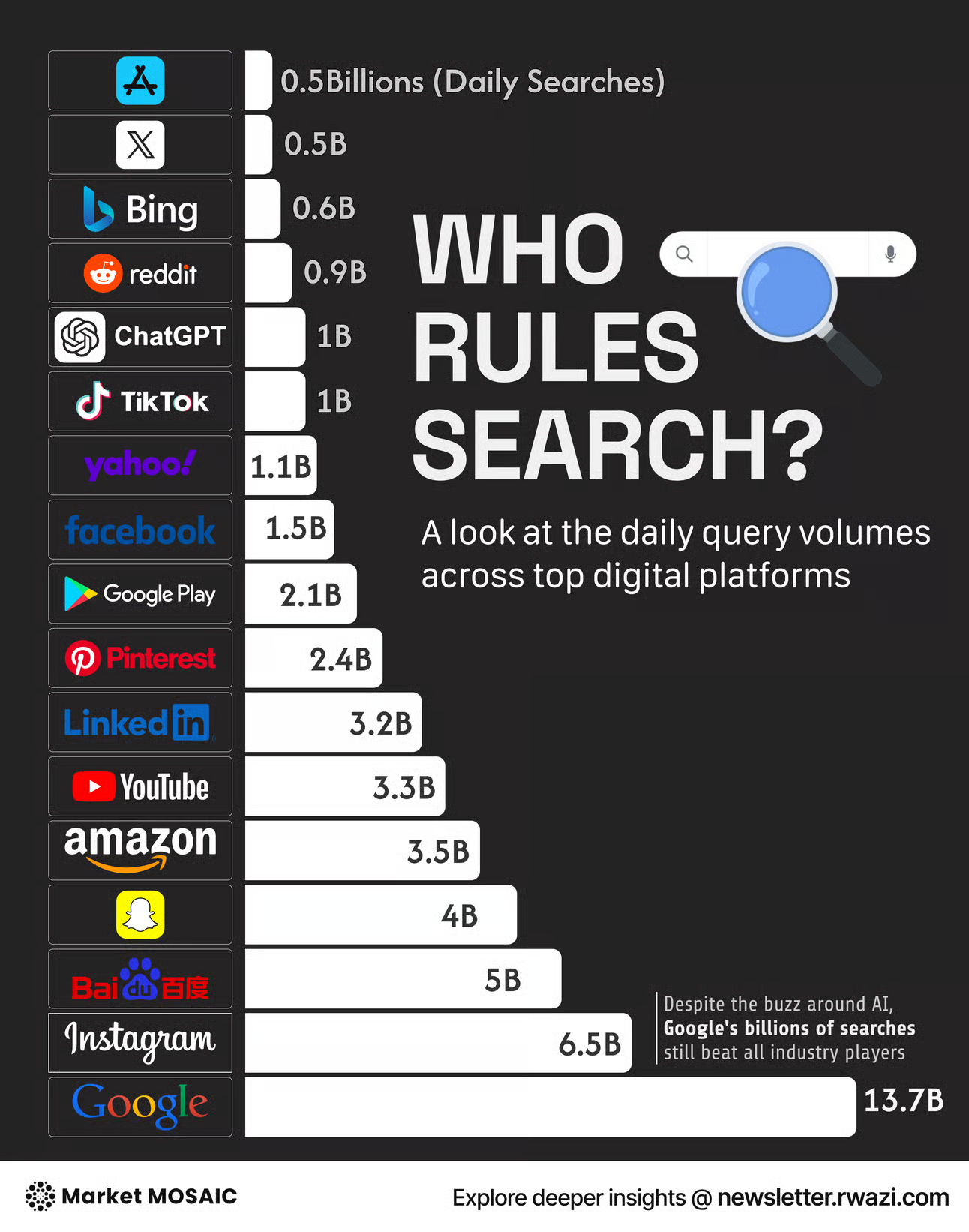

Google processes billions of searches every day, while AI tools even collectively generate a fraction of that query volume.This gap highlights the difference between growth rate and total market share. AI search is expanding rapidly, but the absolute scale of traditional search remains unmatched.

Three structural forces reinforce this dominance:

Default distribution: In 2025, Google rolled out AI overviews, a generative AI answer built directly into search results across more than 200 countries. Gemini, Google's AI model, is now embedded across search, Gmail, Docs, and Android, with over 750 million active users reported. Google is embedded across devices, browsers, and operating systems. Many users never change default search settings, and behavior follows convenience.

Ecosystem gravity: Integration with platforms such as Android, Chrome, and YouTube creates discovery loops that keep users within a single environment.

Advertiser economics: Search advertising remains one of the most reliable digital revenue channels. That economic engine sustains continuous investment in search infrastructure and product innovation.

For executives evaluating competitive risk, AI may reshape interfaces, but scale and distribution still determine dominance.

Why Google’s advantage persists

Understanding Google’s persistence requires looking beyond technology to distribution, economics, and psychology. Search behavior is deeply ingrained. Many users treat search results as a validation layer, even when AI provides answers. Familiarity creates trust, and trust shapes behavior.

Google’s ecosystem further compounds engagement. Maps, productivity tools, video, commerce, and search interact seamlessly, creating breadth and convenience that make switching to alternatives more difficult.

AI as a complement, not a replacement

The emerging pattern across consumer and enterprise usage is complementary behavior rather than direct competition. AI excels at early-stage exploration. Search remains dominant for verification, sourcing, and navigation.

AI prioritizes synthesis and speed. Search prioritizes breadth, source diversity, and credibility signals.This complementarity explains why AI adoption has not translated into rapid erosion of Google search market share. Discovery is expanding outward rather than moving entirely.

What this means for brands, publishers, and founders

The persistence of search dominance alongside AI growth creates both stability and disruption.

AI summaries may reduce direct website visits, creating traffic risk for publishers. Companies can mitigate this by emphasizing brand authority, newsletters, and community engagement, ensuring their insights reach decision-makers.

At the same time, AI-driven discovery can surface niche sources. Smaller brands have an opportunity to gain visibility without necessarily ranking at the top of search results, as AI recommendations increasingly highlight credible, specialized content.

For business leaders, distribution remains the hardest challenge. AI may accelerate discovery, but the scale and infrastructure of search still govern how insights flow to markets and inform strategic decisions..

The outlook: can Google keep its lead through 2030?

Forecasting the future of search requires balancing structural advantages against behavioral change.

On one side, Google’s distribution, infrastructure, and ecosystem provide strong defenses. Market share erosion, if it occurs, is likely gradual.

On the other, AI is reshaping expectations. Users increasingly expect answers instead of links. This shift pressures search engines to evolve interfaces and monetization models.

Google’s strategy reflects adaptation. AI integration into search results suggests convergence rather than resistance. Instead of competing with conversational discovery, search is absorbing it.

Continue reading: AI monetization war in 2025 →

Related: AI user acquisition →

Related: AI retention hacks brand must copy →

FAQs

Will AI replace Google search?

AI is reshaping discovery behavior, but search engines still dominate query volume and navigation.

Why does Google still dominate search?

Distribution advantages, ecosystem integration, and user habits sustain Google’s leadership.

How much market share does AI search have?

AI search adoption is growing quickly but represents a small share of global queries.

How should companies adapt their SEO strategy?

Organizations should combine traditional search optimization with content structured for AI visibility and citations.

Join thousands of forward-thinking brand leaders already staying ahead with Market Mosaic, our weekly newsletter packed with real-time trends, economic pressure points, and granular data