How AI Agents are shaping finance and accounting for businesses

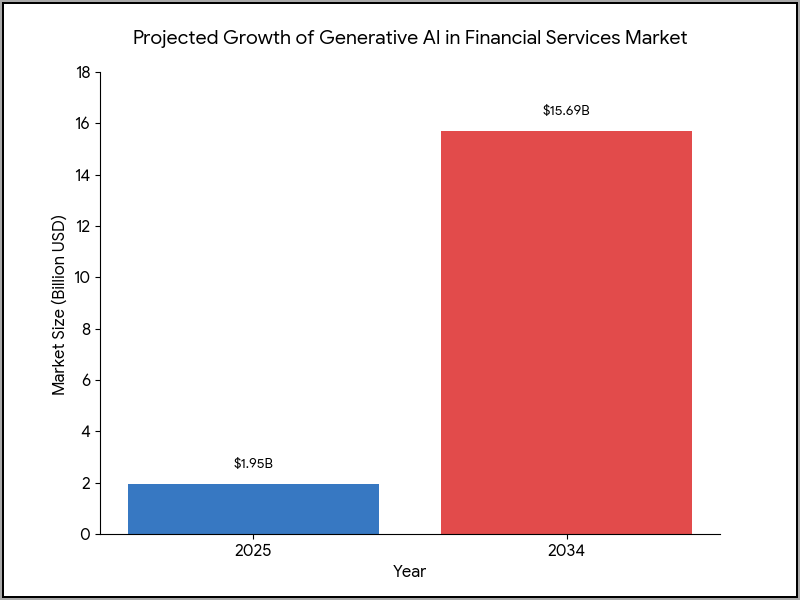

Generative AI is not just a tool; it’s an autonomous force revolutionizing finance. AI Agents are set to drive the market from $1.95B to $15.69B by 2034, by automating bookkeeping (47.8% CAGR) and providing real-time credit scoring in emerging markets

The era of real-time financial intelligence

The digital backbone of global finance is cracking under the weight of its own data. The Generative AI in Financial Services market is projected to hit $15.69 billion by 2034, expanding from a base of $1.95 billion in 2025 alone.

This explosive growth is fueled by the rise of AI agents which are autonomous software systems capable of executing complex financial tasks, from drafting reports to real-time risk mitigation, with minimal human oversight.

The global cost of lagging data

For years, core business operations from inventory management to product pricing have been governed by outdated financial models.

The global problem is twofold: data scale and analysis speed. Unstructured data, like contracts, vendor emails, and global news feeds, now determine financial risk, yet no human team can process it fast enough.

This lag prevents founders from seeing cash flow constraints or pricing inaccuracies in real-time, often leading to costly, delayed decisions. Companies are losing their competitive edge because their finance department can only report what happened last month.

The business-wide automation leap

The revolution is moving beyond simple data entry. The adoption of AI in key functions like automated bookkeeping is set to surge at a 47.8% CAGR, primarily by transforming three business pillars.

AI agents are now managing tasks like accounts payable and receivable, automating invoice matching against purchase orders, and handling vendor payment outreach. This reduces friction in the supply chain and liberates staff from administrative burdens.

In emerging markets, the technology bypasses the need for extensive traditional banking infrastructure. For businesses launching in Africa or Southeast Asia, AI agents provide instant, accurate credit scoring for new customers and analyze highly localized consumer transaction data, an insight critical for market penetration that was previously only available through costly, slow human research.

Major platforms are embedding AI, with firms like SAP integrating over a hundred GenAI capabilities. This allows finance departments to run dynamic scenario modeling, immediately simulating the impact of a tariff hike or a supply chain disruption on their bottom line.

Key insight for business leaders

For any CEO, founder, or CFO, the strategic deployment of generative AI is now a matter of operational survival, not just cost-cutting. Companies should implement a real-time cadence, shifting core financial reporting and planning cycles from monthly to continuous.

AI agents deliver instant dashboards and flag anomalies the second they occur, enabling dynamic pricing, smarter inventory decisions, and proactive risk mitigation across the entire operation. It is also essential to insist on localized data integrity.

The biggest failure point of global AI deployment is data bias, so AI agents making pricing or credit decisions in emerging markets must be trained on authentic, on-the-ground consumer data to ensure accuracy and compliance.

Finally, elevating the finance team is critical. By automating routine data assembly, finance shifts its focus from historical reporting to strategic insight and predictive analysis, fundamentally transforming its role from record-keeper to co-pilot for the C-suite.

The path to autonomous advantage

Generative AI is not just a tool; it is the definitive roadmap to full financial automation, fundamentally reshaping how businesses make money and manage risk. The competitive edge belongs to the enterprises that move fastest to implement autonomous AI agents, leveraging precise, verified market intelligence to guide their decision engine. As the digital economy demands unprecedented speed, the modern business back office is now an essential frontier for innovation