How economic anxiety is rewiring global spending habits

With global growth revised down to 2.8% for 2025, consumers are entering a new era of caution. From Germany to Kenya, the shopping cart has become a signal of economic sentiment and businesses that miss the shift risk being left behind.

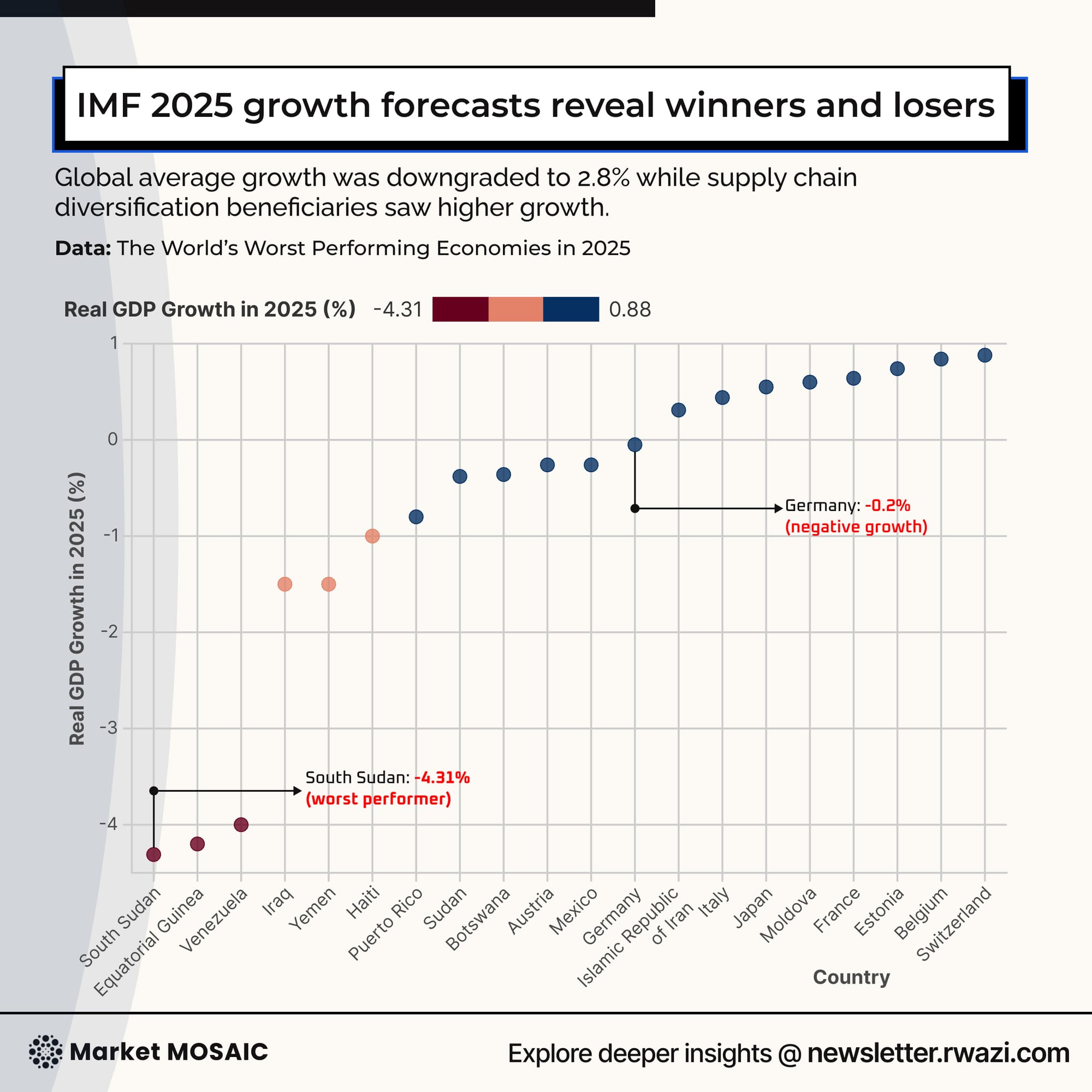

The global slowdown is no longer a forecast, it’s happening. What began as a dip in consumer confidence is now visible in spending data, signaling a broader shift in economic behavior. The International Monetary Fund’s latest forecast projects global growth at just 2.8% for 2025, a notable slowdown compared to the 3.2% estimated for 2024. While that difference may seem small on paper, it marks a clear downward trend in economic momentum. It reflects a broader shift in consumer confidence and global spending behavior.

Unlike previous downturns caused by financial crises or supply chain shocks, the current slowdown is being driven by a sharp decline in consumer confidence. People are holding back not because they have to but because they’re uncertain about what comes next. Consumers are no longer just reacting to price hikes, they’re responding to prolonged instability. In advanced economies, this shift is visible in nearly every sector. A recent consumer behavior report shows that 67% of households are now delaying major purchases, not because they can’t afford them, but because they no longer trust the future enough to commit.

Spending Fatigue Grips Advanced Economies

Germany is a clear example. Once one of Europe’s strongest economies, it’s now expected to contract by 0.3% in 2025. In response, consumer spending on non-essential goods has fallen significantly down 23% year-over-year—reshaping the country’s retail landscape in real time.

In neighboring Austria and Italy, the story echoes. Consumers are tightening budgets, opting for groceries over gadgets, and shelving vacations for utility bills. In these markets, the term “consumer” has quietly become synonymous with “survivor.”

What’s emerging is not a collapse, but a recalibration—Consumers are moving from spending freely to focusing on essentials. Instead of buying based on lifestyle or convenience, people are making careful, value-driven choices. These aren’t just personal budget cuts they’re deliberate decisions that are starting to impact demand, production, and supply chains around the world

Emerging markets signal a new frontier

Yet the narrative is not entirely bleak. While growth slows in developed countries, some emerging economies are starting to pick up momentum. As businesses rethink where they operate and invest, these markets are becoming new areas of opportunity. While nations like South Sudan are projected to shrink economically, others such as Vietnam, Colombia, and Kenya are experiencing unexpected surges in demand. This is largely driven by supply chain diversification. As businesses move manufacturing away from geopolitical fault lines, they are unlocking consumer potential in places once dismissed as too risky or too small.

In these emerging markets, growth is being fueled by mobile shopping, digital payment adoption, and a rise in local startups. What used to be a backup plan shifting operations away from traditional markets is now becoming a key strategy for business expansion. In the process, the global map of consumption is being redrawn.

What business leaders must now understand

With some markets slowing down and others growing fast, today’s business leaders face more than just a typical economic cycle. They’re dealing with a deeper, long-term shift in where consumers are spending and how they make decisions, one that requires a new kind of strategic thinking.

Product lines once optimized for scale must now compete on relevance. In a climate of caution, consumers aren’t just price-sensitive; they are value-conscious, skeptical, and deliberate. Businesses must rethink not just what they sell, but how and where they sell it. It is no longer enough to flood shelves with options. Success now depends on understanding why a consumer hesitates and what might earn back their trust.

Geography, too, is strategic again. For a decade, growth was synonymous with scale. Today, it’s about agility knowing which markets are rising, which ones are receding, and how to shift resources accordingly. Countries like Kenya and Vietnam are no longer afterthoughts in corporate growth plans they’re becoming key markets for innovation. With rising digital adoption, young consumer populations, and improving infrastructure, these regions offer the conditions needed to test and scale new business models that may no longer work in saturated, slower-growth economies.

Pricing strategies must also evolve. Consumers may still want access to premium products, but not all at once, and not without flexibility. Subscription models, try-before-you-buy offers, and outcome-based pricing are gaining traction not as gimmicks, but as responses to genuine hesitation.

What’s ahead isn’t one global trend, it’s many local shifts. The world isn’t spending less, just differently. Companies that adapt early to this new, value-driven consumer will shape the next wave of global growth.