How embedded finance is powering business growth with fintech

Embedded finance is reshaping business growth, turning payments, loans, and insurance into seamless, revenue‑driving experiences

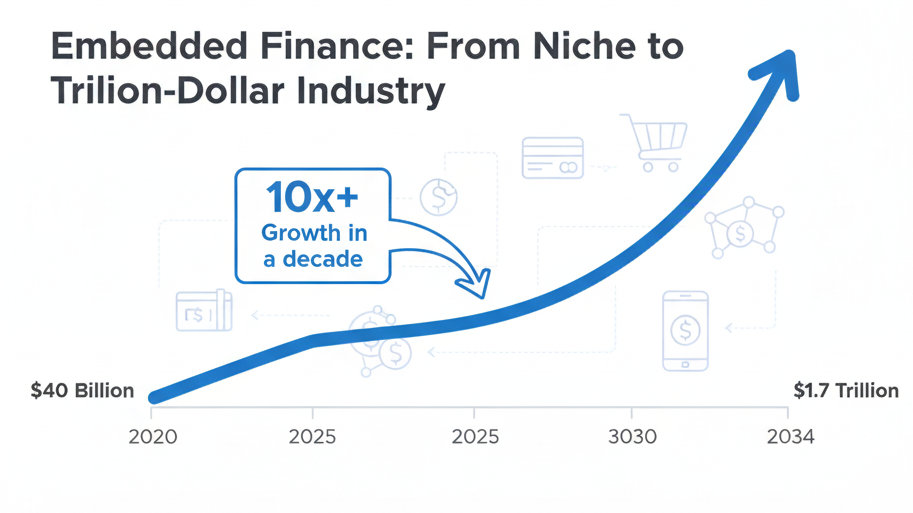

The embedded finance market is on track to reach $7.2 trillion by 2030 driven by platforms that integrate payments, loans, and insurance directly into the products people and businesses use every day. It’s transforming how money moves and how financial services are delivered.

To understand the impact, look at how the world worked before. Paying, borrowing, or getting insured meant navigating separate systems: visiting a bank, filling out forms, waiting days for approvals, or talking to agents. Each service was isolated, slow, and often inaccessible, especially for small businesses and underbanked populations.

Now, embedded finance changes the game. Financial services are no longer confined to banks. Instead, they appear seamlessly inside apps, marketplaces, and platforms. You can book a ride and get instant insurance for your trip, shop online and access a small loan at checkout, or pay a vendor directly from a business app all without leaving the platform.

Transactions happen instantly, financial access expands, and users stay engaged within the platforms they already trust. For businesses, instead of relying solely on banks, they can embed financial tools via APIs or fintech partnerships, turning their products into mini financial ecosystems.

Why traditional banking still holds businesses back

In many parts of Africa, Asia, and Latin America, banking hasn’t kept up with how people live and work. Small businesses struggle to get credit. Payments take days to clear. Cash still dominates. That slows down growth and limits opportunity for millions of entrepreneurs.

Fintech and mobile payments fill the gap

Emerging markets aren’t waiting for traditional banks to catch up, they’re leapfrogging straight to digital solutions. Fintechs and mobile payment platforms are turning everyday apps into financial hubs, bringing speed, convenience, and access where it was once limited.

Take India’s Unified Payments Interface (UPI). In June 2025 alone, it processed over 18 billion transactions, connecting millions of small businesses, street vendors, and consumers directly through their smartphones. Meanwhile, in Mexico, just under half of adults have a bank account—but platforms like Mercado Pago are embedding payments, credit, and savings right into merchant and consumer apps, creating instant access to financial tools.

Across Southeast Asia, platforms like Grab and Shopee are transforming from ride-hailing and e-commerce apps into full-service financial ecosystems. Users can get loans, insurance, or payment services without ever leaving the app. The effect is clear: financial inclusion is expanding at a pace traditional banks have struggled to achieve.

Embedded finance doesn’t just add convenience, it shifts the power to platforms that understand users’ behaviors and needs. Businesses can now serve more customers, shorten cash flow cycles, and increase retention. For consumers and small businesses, it means financial tools are finally meeting them where they live: on their phones, at the point of need.

Key insight for businesses

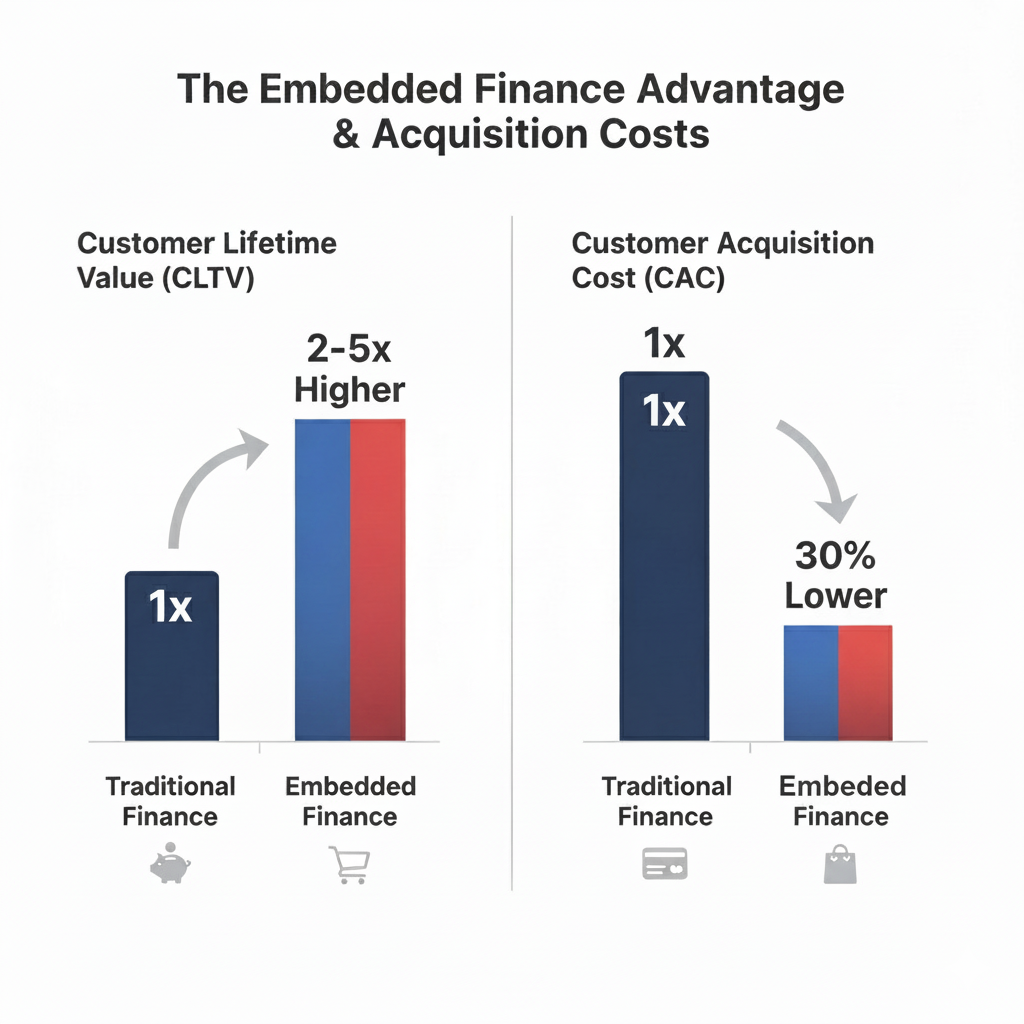

For founders and business leaders, embedded finance is more than a feature, it’s a growth engine. By integrating payments, loans, and insurance directly into your platform, you turn every transaction into an opportunity.

Imagine an e-commerce site offering instant credit at checkout, a delivery app giving drivers access to micro-loans, or a marketplace providing in-app insurance for sellers. These services don’t just make life easier for users, they create loyalty, boost transaction volumes, and generate new revenue streams.

The shift also allows businesses to reach customers who were previously excluded from formal financial systems. In emerging markets, where banking infrastructure is limited, platforms that embed finance can unlock entirely new segments. The result is faster growth, deeper engagement, and stronger customer relationships all without the friction of traditional banking.

Embedded finance transforms the way businesses operate: the financial journey moves from a separate, slow process to a seamless, integrated part of the product experience. Companies that embrace this change gain a clear competitive edge