How the 2025 U.S. govt. shutdown is shaping consumer spending

The 2025 U.S. government shutdown is hitting households and businesses hard. With federal workers not paid, SNAP benefits at risk, and economic data delayed, consumer spending slows, forcing companies to adapt to financial strain and uncertainty.

The immediate strain on households

The federal government shutdown that started on October 1, 2025, is already testing the resilience of U.S. consumers.

Federal employees face furloughs or must work without pay, contractors wait on delayed invoices, and essential programs such as SNAP are funded only through the end of the month.

For households that rely on government stability, this creates a full stop. Consumer confidence wavers, discretionary spending slows, and businesses dependent on predictable cash flow suddenly encounter risk. Council of Economic Advisers’ projects that a month-long shutdown could reduce consumer spending by as much as $30 billion.

In an economy where consumer spending accounts for roughly 70 percent of activity, the stakes are significant.

Data signals and market impact

The core of the economy runs on confidence, and robust consumer spending drives nearly 70% of U.S. Gross Domestic Product (GDP)

Card transaction trends show declining discretionary purchases, while retail sales trackers reflect uneven spending patterns.

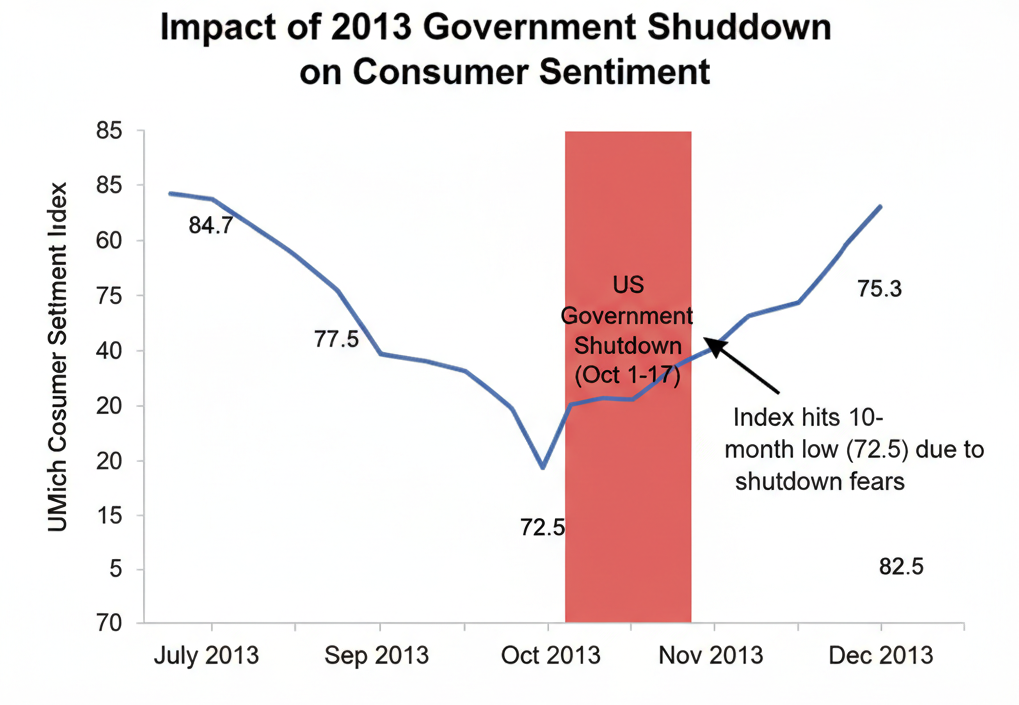

The University of Michigan’s consumer sentiment index slipped in October, hitting its lowest since April, reflecting heightened caution among workers evaluating job security.

There have been only modest growth in consumer spending across many districts, with some reporting flat or declining activity.

Historical shutdowns provide context: the 2018–19 partial shutdown reduced GDP growth by 0.1–0.2 percentage points. Our analysis project similar short-term impacts if the current shutdown continues, but the longer-term effect could come from eroded confidence rather than lost income alone.

More critically for business leaders, the shutdown creates an unprecedented state of economic uncertainty by triggering a data blackout as key economic releases from CPI to employment are delayed or at risk entirely, thereby by increasing hesitancy and risk aversion across the private sector. This vacuum is forcing an accelerating reliance on alternative data.

Strategic responses for businesses

The shutdown presents both a challenge and an opportunity. Retailers can adjust promotions and inventory around federal payroll cycles.

Financial services and fintech firms can anticipate income disruptions and provide tailored options for government-affiliated customers.

Product teams can prioritize essentials or subscription-based models to maintain predictable revenue even as discretionary spending contracts.

Companies must build infrastructure to ingest and interpret real-time transaction data and localized consumer behavior, ensuring their operational and capital allocation decisions are based on truth, not outdated consensus.

Looking ahead: managing uncertainty

If funding is restored promptly, the economic impact may remain contained. If delays persist, the deeper risk comes from reduced consumer confidence and delayed economic data, with potential ripple effects extending into 2026.

Founders, CEOs, and business leaders must model exposure, monitor consumer signals closely, and maintain agility. The ability to sense and respond to granular shifts in consumer spending will separate market leaders from market victims.

Follow Rwazi for insights that turn raw data into actionable strategy, providing a clear view of how markets respond during periods of uncertainty.