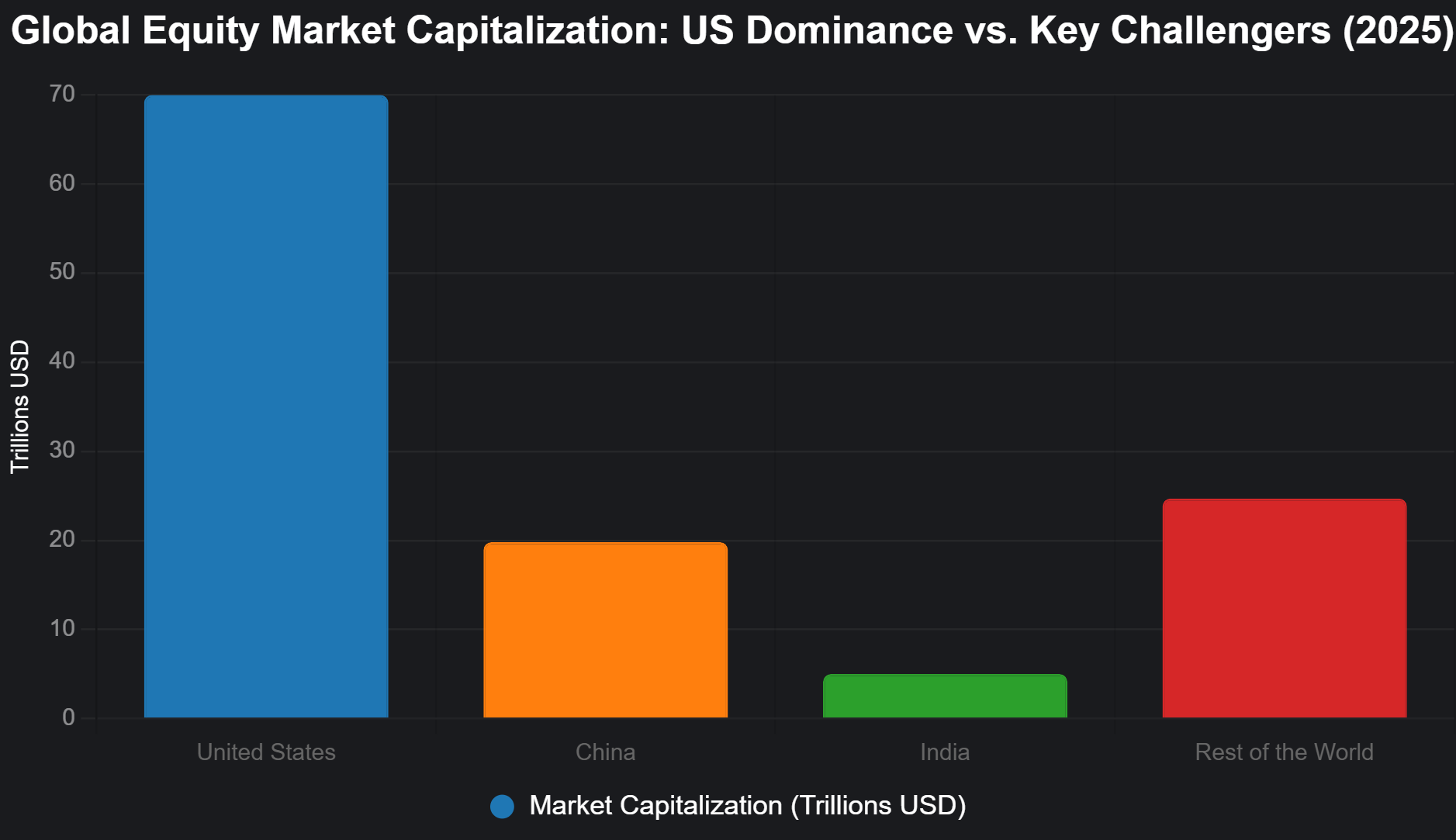

How the U.S. holds $70 trillion in stocks while BRICS catch Up

Global stock markets, basically the total value of all publicly traded company shares are still dominated by a few big players.

The United States alone sits at nearly $70 trillion, more than every other country combined. That kind of dominance doesn’t just look impressive on paper, it drives where investors put their money, how companies plan growth, and which markets get the most attention.

Why the G7 holds structural advantage

The G7; made up of the U.S., Canada, the U.K., France, Germany, Italy, and Japan dominates global markets because these countries have stable systems, strong financial infrastructure, and innovative companies.

Within the G7, the United States stands out, making up nearly 60% of the group’s total market value. Its strength comes from a few key area;

Technology leadership: Apple, Microsoft, Alphabet (Google), Amazon, and Meta anchor global innovation, contributing trillions in market cap.

Financial powerhouses: JPMorgan Chase, Goldman Sachs, and BlackRock drive capital allocation worldwide.

Healthcare and pharmaceuticals: Johnson & Johnson, Pfizer, and UnitedHealth strengthen U.S. resilience in life sciences.

Consumer dominance: Walmart, Procter & Gamble, and Coca-Cola reflect the scale of domestic demand and brand leadership.

These industries show why U.S. stocks are bigger and more diverse than anywhere else. Strong markets, solid rules, and wealthy consumers keep investors confident and willing to put their money in U.S. companies.

Why China leads BRICS markets

The BRICS bloc; Brazil, Russia, India, China, and South Africa, with new members Saudi Arabia, Egypt, Ethiopia, and Iran was formed as a counterweight to Western dominance. While less politically aligned than the G7, these economies share an ambition to rebalance global capital flows.

China leads this group with $19.8 trillion in market capitalization. Its strength lies in three primary sectors:

E-commerce and technology: Alibaba, Tencent, and JD.com shape consumer and digital markets.

Banking and finance: ICBC and China Construction Bank rank among the world’s largest financial institutions.

Industrial and manufacturing power: Firms like BYD (electric vehicles), Huawei (telecoms), and global renewable energy leaders drive scale.

China’s strength across multiple sectors makes it the clear leader in BRICS, but its markets face challenges. Unpredictable regulations, strict capital controls, and geopolitical tensions make it harder for foreign investors to participate

India as BRICS’ growth engine

India has crossed the $5 trillion equity market threshold, positioning itself as the bloc’s fastest-rising growth story. Its advantages come from:

Technology and services: Infosys, Tata Consultancy Services, and Wipro dominate IT and outsourcing.

Industrial and consumer growth: Reliance Industries and Adani Group reflect both manufacturing expansion and surging domestic demand.

Demographics: A young population and expanding middle class underpin long-term consumption growth.

This trajectory positions India as a credible counterweight to China, especially as global supply chains diversify away from Beijing’s orbit.

Insights for business leaders and investors

The U.S. market is still the safest bet. It’s big, liquid, and stable, which makes it the go-to place for raising capital or listing your company. Investors can feel confident there, knowing the system is reliable.

At the same time, fast-growing markets like India are impossible to ignore. With a young population, rising middle class, and booming tech and industrial sectors, these markets are full of opportunity for companies and investors looking for growth.

Putting all your eggs in one basket, however, can be risky. Changes in U.S. interest rates, new regulations in China, or disruptions in resource-heavy countries can affect global investments and business operations. The smart approach is to stay anchored in the stability of the U.S. while selectively exploring high-growth markets in BRICS.

While the U.S. will likely stay the main hub for the near future, power is slowly spreading. India is rising fast, China remains strong, and Saudi Arabia is growing its influence. Businesses and investors that can balance the security of established markets with the energy of emerging ones will have the best chance to succeed.