Inside the $1.5 trillion subscription economy: the breaking point

The $1.5T subscription economy faces a reckoning. Consumers now pay for 3.7 services but use just 2.3, wasting $273 yearly. As budgets tighten, only platforms delivering clear, daily value will survive the coming shakeout.

American households now maintain an average of 3.7 subscriptions but actively engage with only 2.3 of them. It represents $273 in annual waste per household, according to our consumer spending analysis.

The subscription model that conquered software, media, and fitness has hit its breaking point. Consumers are auditing expenses with spreadsheet precision, and services relying on forgetfulness over value are running out of time.

The $1.5 trillion subscription economy built itself on a faulty assumption: that consumers would keep paying forever.

The illusion of value

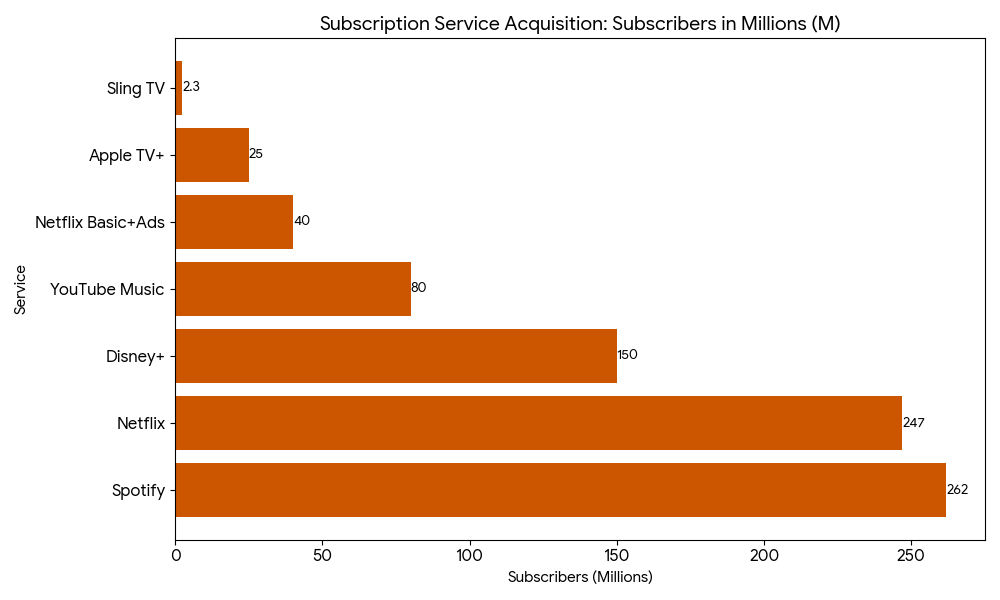

Music streaming shows what works. Spotify, Apple Music, and YouTube Music all charge $10.99 monthly which is stable pricing that reflects clear value per hour consumed; unlimited access, algorithmic discovery, offline listening. Users know what they're paying for and actually use it.

Video streaming reveals what doesn't. Prices range from Apple TV+ at $9.99 to Sling TV at $40, reflecting an industry still unsure what it's selling. This pricing chaos exists because engagement doesn't match subscription counts.

Here's proof engagement doesn't match subscription counts: 37% of new streaming subscribers now choose ad-supported tiers. Consumers are doing math. They're calculating whether $15.99 justifies their viewing hours or whether four commercial breaks at $6.99 delivers better value.

The New York Times cracked this code with 9.7 million digital subscribers—nearly triple the Wall Street Journal's base. The Times built daily habits through consistent engagement. Millions of professionals open the app before morning meetings, creating behavioral patterns that make cancellation unthinkable. This distinguishes essential services from expendable ones.

When abundance becomes burden

The subscription economy is projected to reach $1.5 trillion by 2033, propelled by relentless expansion into every corner of consumer life. Meditation apps, recipe platforms, fitness classes, cloud storage, password managers, VPNs, professional networking. Despite growth in gross subscriptions, engagement is not keeping pace with acquisition.

The average company now uses 130 SaaS applications, up from 80 just five years ago. IT departments have lost track of what employees are actually using. Unsanctioned subscriptions purchased by individual teams creates redundancy, security vulnerabilities, and millions in duplicated spending.

The coming consolidation

The next 12 to 18 months will force a reckoning across the subscription economy. Services that survive will share specific characteristics: clear measurable value users can defend during budget reviews, integration into daily routines deep enough that cancellation feels disruptive, and pricing flexibility acknowledging actual consumption patterns

Amazon Prime demonstrates the winning playbook. It's technically a subscription, but it functions as infrastructure. Free shipping, video streaming, music, reading, photo storage, and grocery delivery bundled into one $139 annual fee. Canceling Prime doesn't save money, it creates friction across a dozen weekly transactions. It's an ecosystem lock-in strategy disguised as membership benefits.

What business leaders must do now

If you run a subscription-based business, your metrics need revision. Acquisition is no longer the goal, retention is. Measure daily active usage, feature adoption, and session frequency to understand whether your product is essential or expendable.

Make value visible. Show users their tangible outcomes; hours streamed, projects completed, goals achieved. When people can see progress, they see reason to stay.

Introduce pricing flexibility before the market forces it. Spotify’s freemium model keeps users engaged without alienating price-sensitive customers. Premium feels like a choice, not a trap.

The companies that win won't be those with the most subscribers. They'll be the ones with the most engaged subscribers, the clearest value propositions, and the deepest integration into the workflows that actually matter.

Follow Rwazi for data-driven insights on how market shifts are reshaping business strategy and creating new opportunities for sustainable growth.