Nvidia’s AI chip monopoly is cracking amid rising competitors in 2025

Nvidia dominates the AI chip market, but competitors like AMD, Intel, and Micron are gaining fast. Rising alternatives promise more innovation, lower costs, and a resilient supply chain, reshaping how businesses access AI-powered technology in 2025.

The story behind Nvidia’s lead

AI depends on powerful chips, and for years, Nvidia’s GPUs (graphics processing units) have been the default choice for training and running large-scale AI models.

These chips aren’t just for gaming, they’re optimized to handle massive amounts of parallel computation, making them ideal for deep learning, natural language processing, and generative AI.

Every major cloud provider, from Amazon Web Services to Microsoft Azure and Google Cloud, has relied on Nvidia GPUs to power their AI operations, including applications like ChatGPT, DALL·E, and large recommendation engines.

NVIDIA AI Chip driving innovation among industriesNN

Tech giants, startups, financial institutions, and even healthcare companies use these chips to accelerate data-intensive workloads such as fraud detection, drug discovery, and predictive analytics.

That level of control created bottlenecks. Nvidia’s GPUs became so critical that hardware shortages delayed projects, prices soared, and developers and enterprises often had to wait months for access.

Now, the market is adjusting. The push for alternatives isn’t driven by preference but by necessity, as businesses look to avoid dependency on a single supplier while meeting the growing demand for AI-powered solutions.

A changing balance of power

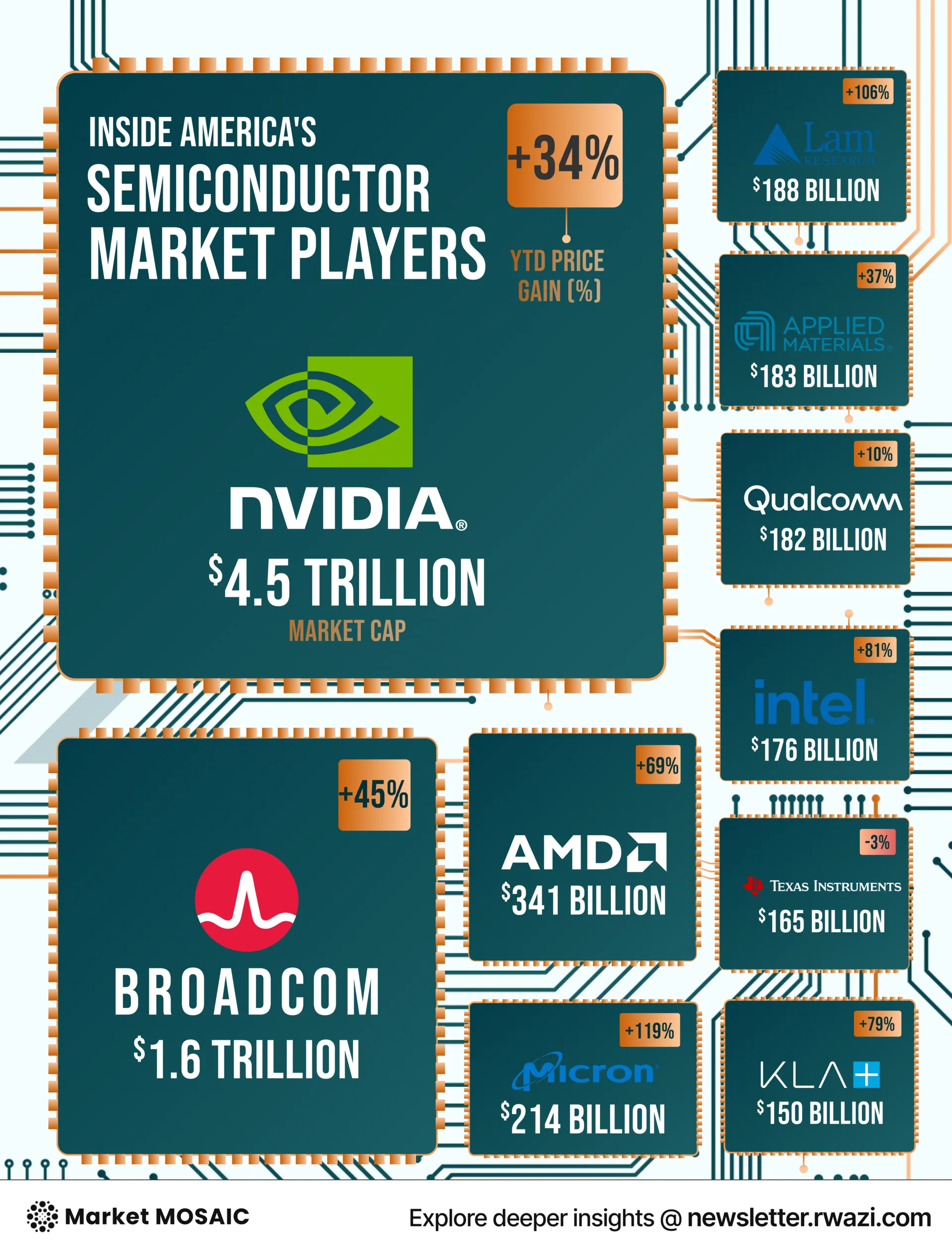

Nvidia still sits comfortably at the top of the AI chip market, holding about 80% of global share and a market cap near $4.5 trillion. But that dominance is starting to show cracks.

Competitors like Micron, Lam Research, Intel, and AMD are gaining ground fast.Micron Technology has climbed 119% this year, driven by record demand for high-bandwidth memory that fuels AI servers.

Lam Research is up 106%, Intel 81%, and AMD 69%, boosted by a multi-billion-dollar GPU supply deal with OpenAI. Together, these companies are reshaping what once looked like a one-sided race.

Tracking the contenders

Micron has positioned itself as a critical supplier in the AI boom, expanding capacity in Japan and the United States to meet surging memory demand.

AMD’s partnership with OpenAI cements its status as the most serious challenger to Nvidia’s data-center dominance. Intel is re-entering the race with a new inference-optimized chip called Crescent Island, part of its broader plan to regain relevance in the AI space.

Lam Research, which makes the machines used to manufacture advanced semiconductors, continues to benefit from record investment in chip production across Asia and North America.

Each of these moves shows a a broader industry realignment. The AI supply chain is no longer built around a single company, it’s evolving into a network of specialized players pushing the boundaries of what’s possible.

Key insight for business leaders

AI infrastructure is no longer controlled by a single player, and supply chains are diversifying rapidly. Companies that rely on Nvidia alone risk bottlenecks, higher costs, and slower innovation.

Leaders should design AI strategies that leverage multiple chip suppliers, optimize for energy efficiency, and anticipate supply‑chain or geopolitical disruptions.

Acting now to embrace flexibility and resilience will make AI adoption faster, more cost-effective, and more scalable across their businesses.

Subscribe to Rwazi newsletters for more stories on how data, competition, and technology are reshaping the future of industries.