Social Media 2025: Habits Beat Hype

Established platforms like YouTube and Facebook stay dominant because habits are harder to break than trends.

Why YouTube and Facebook still dominate consumer attention despite platform innovation

In our latest round of consumer behavior analysis at Rwazi, we noticed something that cuts through the noise. Everyone keeps talking about how social platforms are fragmenting and how “the next big app” is always around the corner.

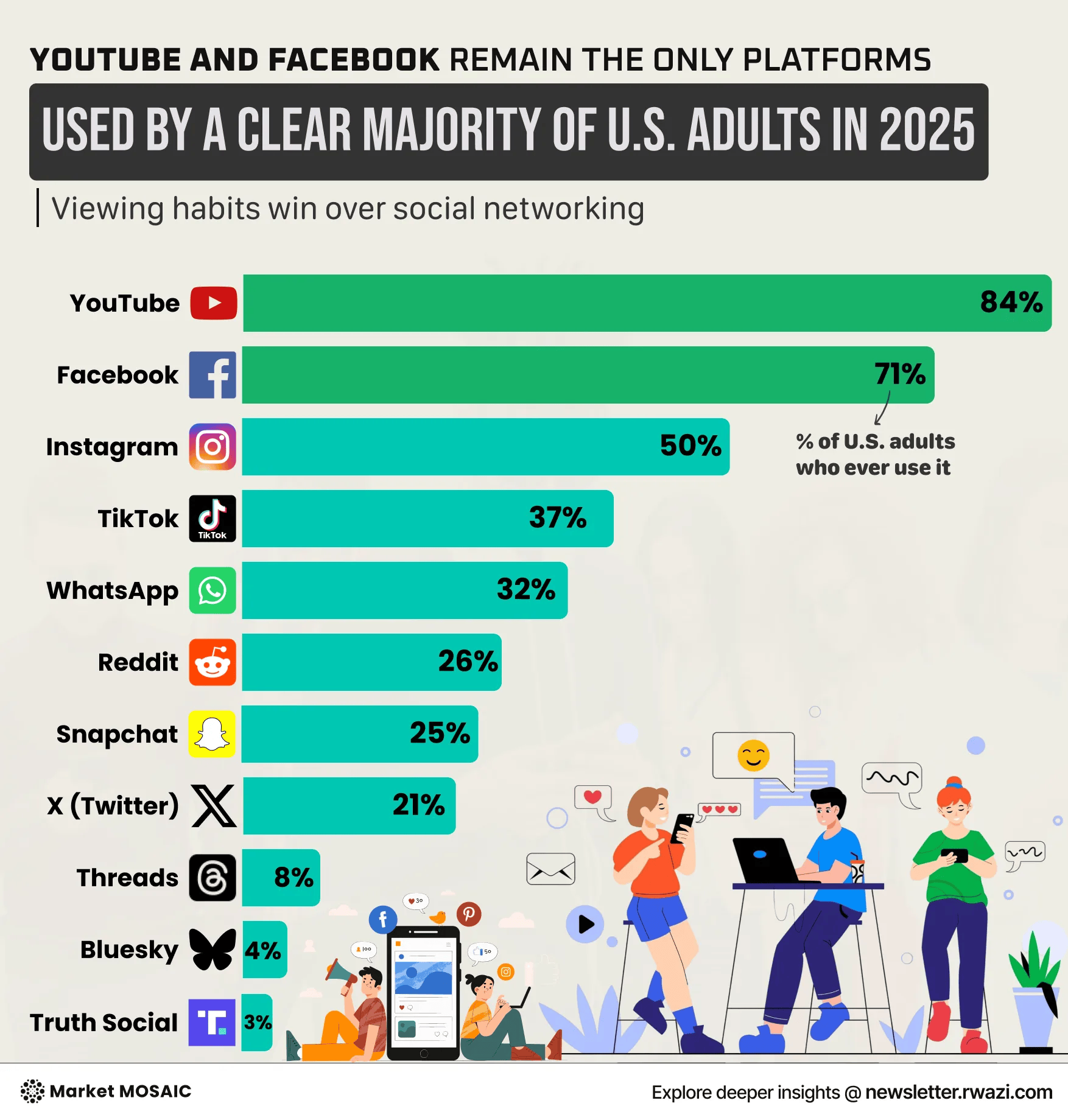

But when you look at how people actually behave, the story shows most users aren’t moving anywhere.Pew Research Center’s numbers drive it home. YouTube reaches 84% of U.S. adults. Facebook holds 71%.

These numbers shows how deeply these platforms have settled into people’s routines. When someone wants a quick video, a news update, or a familiar scroll, they go back to what they know works.

So instead of a year of sudden shifts, 2025 is shaping up as a reminder of just how sticky digital habits really are.

Why leading platforms continue to dominate

People often talk about being tired of social media or wanting something new. But the daily data doesn’t support that. Almost half of U.S. adults open YouTube or Facebook at least once a day.

When an app becomes part of your everyday rhythm like that, everything else follows — creators keep posting, advertisers stay invested, and users don’t feel the need to look elsewhere.Our teams across US, Africa, Asia, and Latin America are seeing the same thing.

YouTube and Facebook didn’t just launch early, they became part of people’s online routines long before today’s wave of apps even existed. They set the tone for how we watch, share, and interact. Over time, that early presence turned into familiarity, and that familiarity turned into habit.

That’s why they’ve stayed dominant. It’s not that newer platforms lack creativity. It’s that the long-established ones feel stable and predictable, and people stick with what already fits seamlessly into their day.

Once a platform becomes part of someone’s daily pattern, even the most compelling newcomer has to work twice as hard to pull them away.

The reality for new entrants

TikTok shapes culture in a way few platforms can, yet it still doesn’t match YouTube or Facebook in adult reach. Instagram continues to grow but still trails the top two. And then you have X, Threads, Bluesky, Truth Social — each active in their own corners, but far from mainstream.

The challenge isn’t convincing people to try a new platform. It’s getting them to switch their habits. That’s a different battle entirely.

It’s especially tough in emerging markets. Rwazi’s sentiment tracking picks this up clearly: switching platform feels risky, and most users aren’t willing to gamble their limited data on an unfamiliar app.

Key take-away for brands and decision-makers

Despite all the new entrants, most consumer attention still sits in a few stable places. That’s why brands that want reach continue to rely on YouTube and Facebook , because that’s where daily behavior actually happens.

But that doesn’t mean ignoring the newer platforms. It just means giving them the role they’re naturally suited for: testing new ideas, connecting with specific communities, and spotting cultural shifts before they hit the mainstream.

The smartest teams in 2025 are doing both. They focus on the platforms that deliver consistent results, while also testing newer platforms to spot emerging trends and experiment with fresh content formats.

The next big change won’t come from a new app, but from a platform that reshapes daily habits . Until something delivers that level of usefulness, the established platforms stay in control.

How Rwazi helps you stay ahead

To understand these patterns, you need more than big-picture reports. You need to see how real people behave in the markets you care about, what they open first, what they stick with, and what they ignore.

Rwazi’s distributed research network captures these details directly from local consumers, providing the kind of granularity that top-down surveys miss.