The companies powering the $12 trillion AI revolution

NVIDIA, Microsoft, Apple, and other tech giants now control the AI infrastructure powering billions of daily interactions. Asian challengers like Tencent and Alibaba are racing to build sovereignty. This article explores who holds the power behind AI and what it means for businesses and innovation.

The new backbone of global power

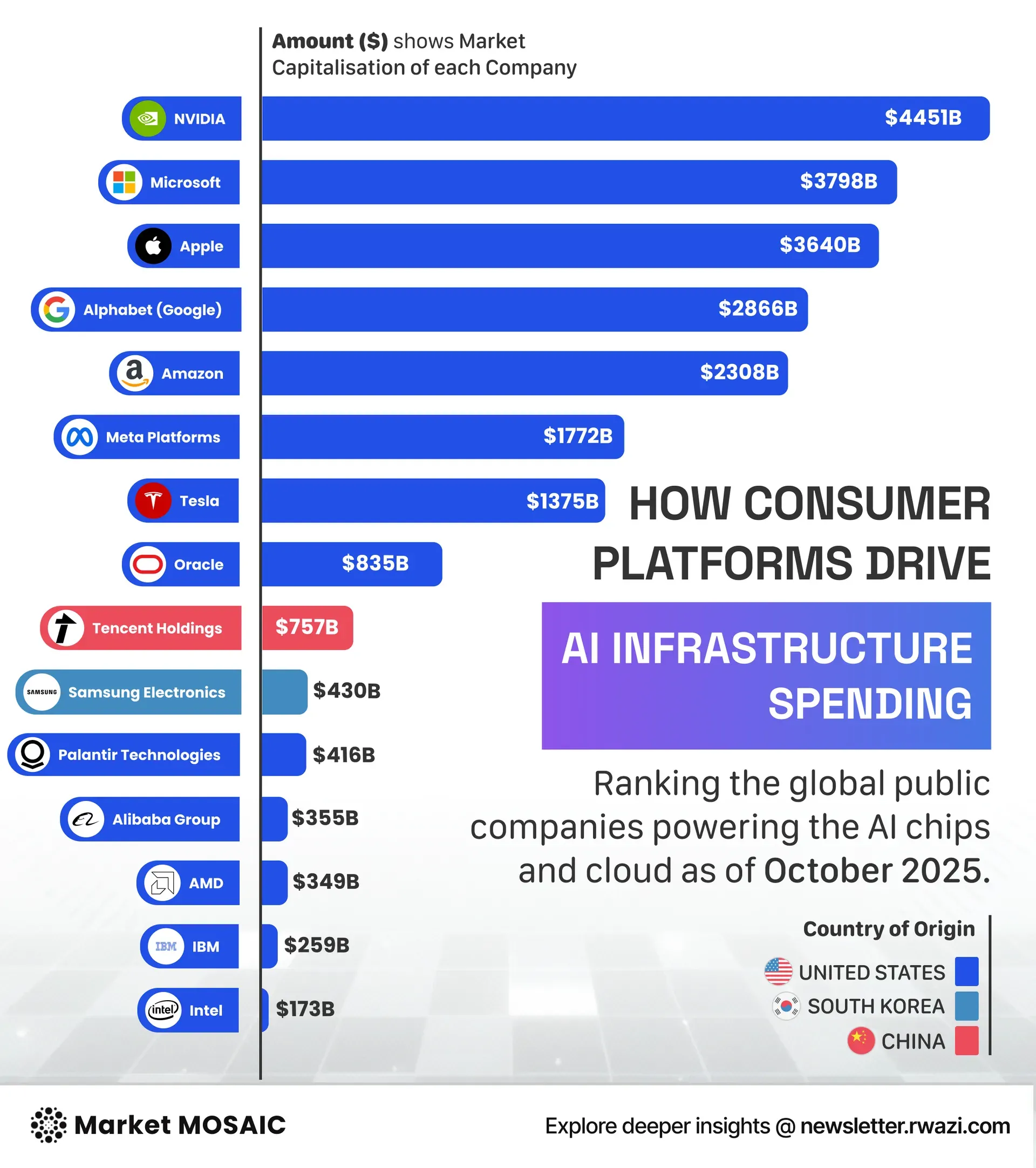

NVIDIA’s $4.45 trillion valuation has turned it into the central nervous system of the AI economy. Every major model, from language engines to image generators, leans on its chips.

Surrounding it is an American circle of power; Microsoft at $3.8 trillion, Apple at $3.6 trillion, Alphabet at $2.9 trillion, Amazon at $2.3 trillion, and Meta at $1.8 trillion. Together, these companies now shape the computational layer through which billions interact with AI every single day.

This consolidation of power is reshaping global technology. The companies controlling the compute layer effectively control the speed, scale, and cost of AI progress. As capital flows toward hardware and cloud infrastructure, the question emerging in boardrooms and government offices alike is who truly owns the foundation of artificial intelligence.

The problem with concentration

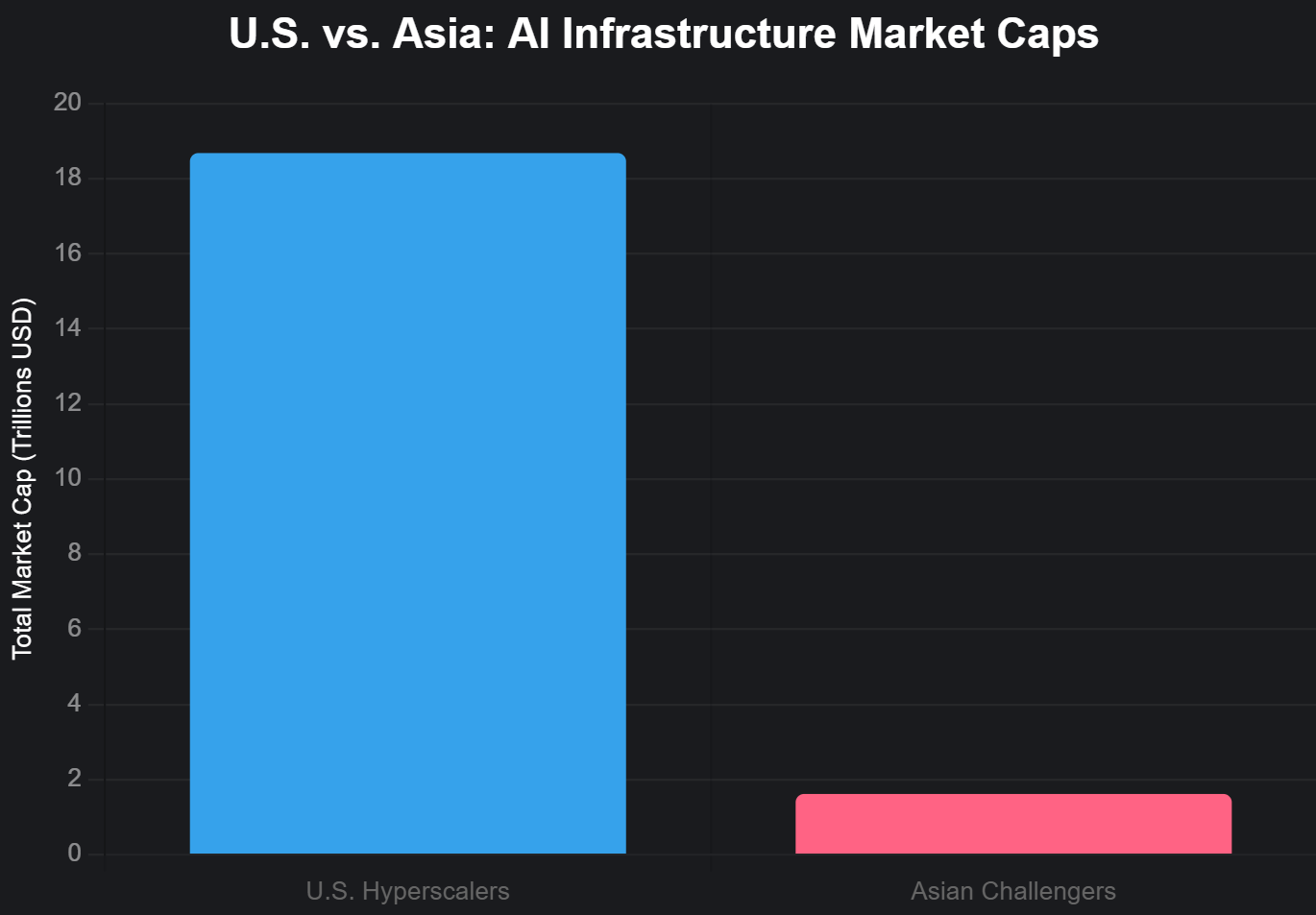

The AI boom has produced a new imbalance. Six American companies now account for more than $18 trillion in combined market value, more than the GDP of Africa and South America combined.

They own the chips, the cloud, and the platforms that power modern AI thereby holding immense leverage over who gets access, how much they pay, and how quickly innovation reaches the world. Their influence now stretches beyond hardware into software ecosystems and cloud services, allowing them to set prices, prioritize clients, and define the rules of engagement across the AI economy.

Across the Pacific, Asia’s tech giants are moving fast to counterbalance this. Tencent, valued at $757 billion, leads China’s software front, while Samsung at $430 billion and Alibaba at $355 billion anchor its hardware and cloud infrastructure. Cambricon, a smaller but strategically important chipmaker worth $73 billion, represents Beijing’s push for AI sovereignty.

Yet the dependency remains deep. China still relies heavily on American or Taiwan-linked chip supply chains, leaving it vulnerable to export controls and political risk.

In the middle of this struggle are firms like AMD, Intel, and Qualcomm, with valuations of $349 billion, $173 billion, and $165 billion respectively. They compete for chip market share but operate in the shadow of NVIDIA’s dominance.

The result is a two-tiered global structure; American hyperscalers at the top, shaping access and innovation, and Asian challengers racing to build sovereignty before the gap becomes permanent.

Solution: build, balance, and decentralize

The path forward lies in spreading out the concentration of compute power while improving how existing capacity is used. China’s experience is a warning sign. Despite the massive buildout of AI data centers, as much as 80 percent of that capacity remains idle. Overbuilding without efficient demand matching turns investment into waste.

Smarter strategies are emerging. Regional governments and private investors are forming partnerships to expand local infrastructure in ways that match actual AI usage.

For countries and enterprises outside the dominant core, Compute power should be treated as a strategic asset, not a commodity. Building regional data centers, investing in diverse architectures, and integrating design with usage can reduce dependency on a small group of global providers.

The concentration of compute power in a few hands gives those companies extraordinary influence over pricing, innovation, and access. As governments and businesses lean more heavily on AI, that concentration could shape global competitiveness and national resilience.

Founders, policymakers, and investors all face the same question: who controls the infrastructure that intelligence runs on? The answer will determine which regions lead in innovation and which are forced to follow.