The great AI market cap collapse

The shockwave

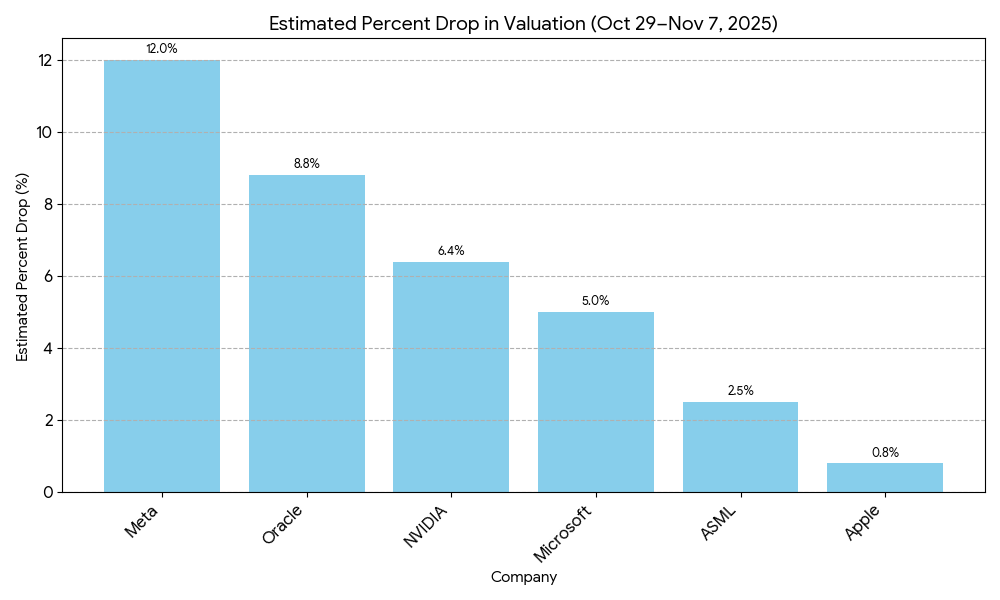

Ten major AI companies collectively lost $1.64 trillion in market capitalization between October 29 and November 7, 2025 which is the steepest correction in the sector’s short but explosive history. NVIDIA alone shed $459 billion, followed by Microsoft’s $333 billion and Meta’s $321 billion (Bloomberg, 2025)

Here's what the data tells us about what happened and what comes next.

The cost of acceleration

For years, the AI race has been fueled by near-limitless capital and sky-high expectations. But the same optimism that once drove valuations to record highs has turned into a reckoning. Investors are questioning whether the billions poured into chips, data centers, and AI models can translate into sustainable profits.

Even Apple, usually protected by its strong hardware business, wasn’t spared — losing $35 billion in value. ASML saw a $21 billion decline in semiconductors, while Oracle dropped $102 billion in enterprise AI. Every layer of the ecosystem felt the correction. The market is showing less patience for unchecked spending and demanding clearer paths to profitability.

The AI reset

This is more than a temporary dip; it marks a reset in market expectations. The sell-off reflects growing concern over AI’s monetization gap — massive investments in models with costs that are still outpacing revenue potential. Analysts note signs of strain, including slower enterprise adoption and questions around the pace of data-center expansion.

Companies in Asia and the Middle East are stepping up with large-scale AI initiatives, from government-backed programs to regional chip partnerships. This new competition is forcing established players to rethink growth strategies. Meanwhile, capital spending is outstripping consumer and enterprise adoption, showing that investment is moving faster than real-world demand.

| Company | Est. Loss (Oct 29–Nov 7, 2025) | % Drop | Key Driver |

|---|---|---|---|

| NVIDIA | $321B | ~6.4% | Chip demand signals cooling |

| Microsoft | $202B | ~5% | Azure AI adoption lag |

| Meta | $232B | ~12% | Capex-revenue mismatch |

| Apple | ~$33B | ~0.8% | Hardware buffer holds |

| ASML | ~$10B | ~2.5% | Supply chain jitters |

| Oracle | ~$92B | ~8.8% | Enterprise AI delays |

Rebuilding on real demand

Investors are shifting focus from speculation to sustainable growth. Rather than building unlimited capacity, the next phase of AI will rely on scaling based on actual demand, matching compute power and model training to use cases that generate measurable revenue.

Startups and enterprise companies that link AI innovation directly to financial results will gain investor confidence faster than those prioritizing model size or technical milestones. The industry is moving toward efficiency-led growth, where return on investment, not hype, determines market leadership.

What smart operators are doing now

Rwazi’s analysis of over 200 AI startups in emerging markets shows how the most resilient companies are adapting. They focus on vertical, domain-specific models instead of general-purpose ones. For example, a medical imaging startup in Nairobi cut training costs by 85% by fine-tuning Llama 3 on 50,000 X-rays, achieving performance comparable to much larger models in their niche.

Infrastructure is being optimized as well. Teams now combine cloud training with on-premises or edge deployment for inference, reducing latency, cutting costs by 40–60%, and improving data security. AMD and Intel are benefiting from this shift with inference-optimized chips priced below NVIDIA’s premium tier.

Business model clarity is another key factor. Subscription pricing for AI tools is stabilizing between $20–$100 per user per month, while usage-based models for high-volume applications are gaining traction. Early experiments by Anthropic and Cohere, which charge for customization and fine-tuning rather than raw token usage, show 35% higher retention rates.

What comes next

The recent $1.6 trillion correction was a repricing, not a collapse, forcing discipline on an industry that had long relied on vision and venture capital.

Consumer adoption remains strong, with AI tools embedding into workflows faster than smartphones did, but investors now demand proof that scale delivers sustainable margins. Compute will remain a battleground, yet edge AI, open-source models, and regional infrastructure are leveling the field.

The winners will be operators who understand unit economics as well as transformers, building products that solve real problems instead of chasing benchmarks. For business leaders, the AI gold rush continues, but the easy money is gone. Success will come to those who adapt quickly, align costs with value, and turn insight into measurable impact.

Join 12,000+ founders and investors getting real-time data on where capital is actually flowing