The AI monetization war: navigating the new advertising economy

In 2026, the AI monetization war is officially here. As ChatGPT introduces ads, the market splits between consumer tools and enterprise intelligence. Here is what brands need to know to stay competitive.

ChatGPT joins the advertising economy

As we move into early 2026, it’s clear that AI is entering a new era. The experimentation years are fading, adoption is widespread, and expectations are clearer. The focus is no longer on what AI can do but rather how it pays for itself.

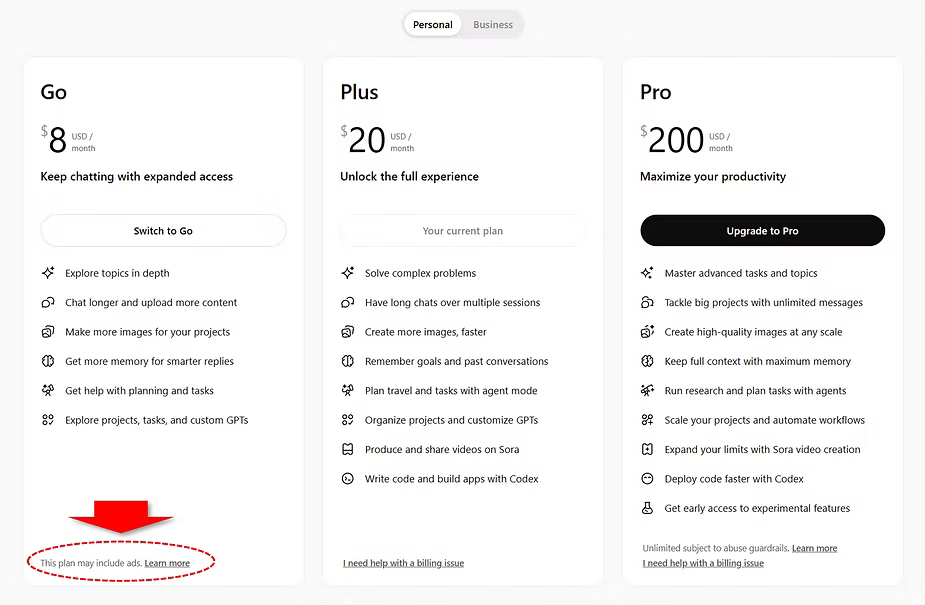

The change became impossible to ignore this week week as OpenAI announced that its popular AI interface, ChatGPT will begin showing ads to free users and lower-cost subscribers.

Travel-related prompts may surface airline offers. Food searches may return branded placements.

For the first time, the world’s most widely used AI interface has formally entered the advertising economy.

Why AI monetization is inevitable

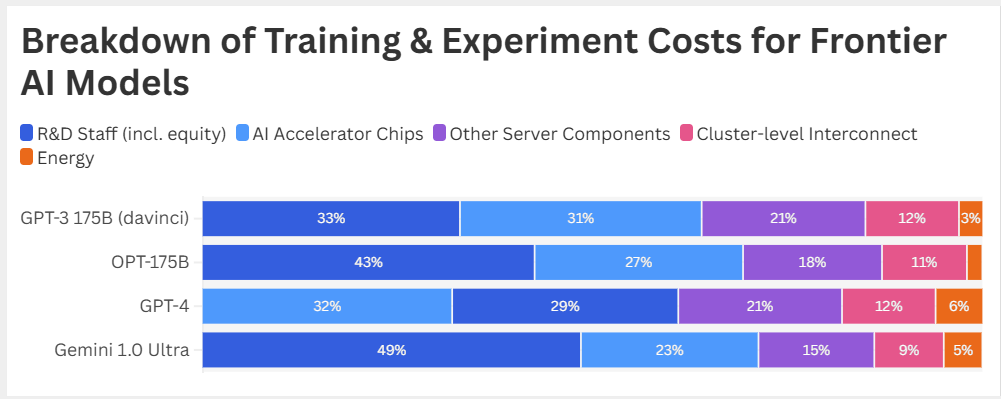

Large AI systems are expensive to run. Compute costs remain high and data centers require constant investment, yet the majority of users remain on free tiers. Most estimates place annual operating costs for frontier AI platforms in the billions of dollars.

For years, that imbalance was sustained by long-term investment and the expectation that monetization could come later. In 2026, that expectation has run its course. Platforms need predictable income.

Advertising is the fastest and most familiar option. It's the same path taken by search engines, social networks, and content platforms once they reached mass adoption. AI platforms are now following suit not as a strategic preference, but as an economic necessity.

The AI market is separating by incentives

With AI monetization now driving the market, tools that once seemed similar are diverging into two distinctly different groups.

- Consumer-grade AI (The Ad-Supported Tier): These tools are built for scale and everyday use. They remain accessible and relatively affordable, but the trade-offs include ads, usage limits, and commercial nudges designed to boost engagement. The quality remains sufficient for casual tasks, but neutrality is harder to guarantee when revenue depends on ad placements.

- Enterprise-grade AI (The Decision Tier): These systems are priced higher and designed differently: no ads, stronger controls around data security, and a focus on accuracy over engagement. They are not built to keep you scrolling; they are built to support high-stakes decision-making.

Key takeaway for brands in 2026

The days of one-size-fits-all artificial intelligence are over. While basic tasks such as copywriting can still be performed using free consumer-level AI, decisions regarding pricing, strategy, and market expansion require decision-level, ad-free intelligence.

Advertising-driven business models can inadvertently taint data and results. If you ask a consumer AI for "the best pricing strategy for 2026," will the answer be neutral, or will it be influenced by the highest bidder?

Investing in quality intelligence, where accuracy is critical, is now necessary to protect brands from costly errors in a split marketplace.

Rwazi delivers the ad-free, real-time, zero-party consumer intelligence brands need to make confident pricing, assortment, and expansion decisions.

Stay ahead of the curve. Join thousands of forward-thinking brand leaders already staying ahead with Market Mosaic, our weekly newsletter packed with real-time trends, economic pressure points, and granular data.

Frequently Asked Questions (FAQ)

1. Will ChatGPT ads affect the accuracy of the answers I get? OpenAI has stated that ads will be clearly labeled and will not influence the organic generation of answers. However, for brands relying on AI for market research, the presence of sponsored content introduces a new variable that must be vetted carefully compared to ad-free enterprise solutions.

2. Why is AI monetization happening now in 2026? The operational costs of running frontier models (like GPT-5 class models) are immense, with some estimates suggesting infrastructure costs could reach hundreds of billions over the next decade. AI monetization via ads is the most viable way to offset these costs for the millions of users on free tiers.

3. What is the difference between consumer and enterprise AI regarding data privacy? Consumer AI often uses conversation history to train models and target ads (unless opted out). Enterprise AI, such as the data provided by Rwazi, is typically "walled off"—meaning data is never used for training public models, and outputs are guaranteed to be free of commercial bias.

4. How can brands avoid "tainted" data from ad-supported AI? Brands should stop using free, consumer-grade tools for critical strategic decisions. Instead, they should subscribe to enterprise-grade platforms or specialized intelligence providers that contractually guarantee ad-free, uninfluenced data streams.